By Simon Turner, InvestmentMarkets | Thursday, 26 September 2024

Welcome to the match. It’s time for a showdown between the green and gold of the Australian equity market and the red, white, and blue of the American stock market. Both countries are fierce competitors with successful track long term records so we can expect a hard-fought match.

We’ll assess our competitors based on three key factors: 1) historical performance, 2) EPS growth, and 3) valuations.

It’s fine to cheer for your team during the match, but please keep it respectful.

Match 1: Historical performance

Let’s start with the relative performance data of the two respective markets over the past fifty years.

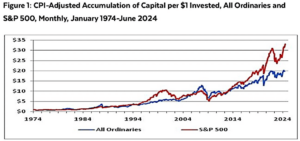

The chart below shows the growth of investments of $1 in portfolios that mimicked the All Ordinaries and S&P 500 Indexes, assuming the reinvestment of dividends and net of inflation. The Australian data excludes the value of franking credits since the introduction of dividend imputation in 1987.

Source: Leithner & Co

The red line of the US market wouldn’t be conquered. It’s been a great half century to be invested in US stocks, and the Australian market hasn’t been able to keep up. The Australian market delivered a 6.1% p.a. compound annual growth rate over the past fifty years, which was 1.1% p.a. below the comparable American performance of 7.2% p.a.

A 1.1% difference may not sound like a lot on an annual basis but as the wide gap between the blue and red lines shows, it compounds into a significant difference over the long term.

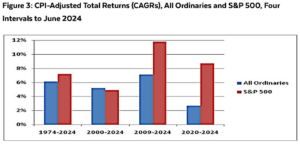

Interestingly, a lot of that US outperformance was generated during the tech boom and since the Global Financial Crisis (GFC). And the outperformance of American stocks since the pandemic has been nothing short of extraordinary—as shown below.

Source: Leithner & Co

That’s one undeniable point to the yanks.

Match 2: EPS growth

Of course, understanding why something is the way is it is the key to understanding whether it will continue.

So we need to ask the question: why have US stocks being outperforming Australian equities?

Some investors argue the main reason is overly generous dividend payments by Australian companies which lead to insufficient retained earnings and capital expenditure.

Others argue that prolonged commodity price weakness, Australia’s heavy exposure to the slowing Chinese economy, tighter monetary policy than in the US, and a lack of global technology leaders are to blame.

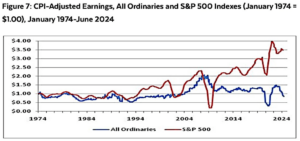

All these factors intuitively ring true, but there’s one over-riding (and connected) issue that can’t be ignored: American EPS growth has greatly exceeded Australian EPS growth over the long term.

As shown below, US EPS growth has been trending upwards since the GFC while Australian EPS growth has been trending lower.

Source: Leithner & Co

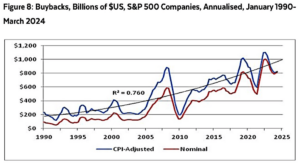

US buybacks have been a key driver of this divergence. As shown below, US companies have been buying back huge amounts of stock in recent years.

Source: Leithner & Co

With US companies embracing buybacks like they are, they have a structural outperformance engine that’s likely to keep delivering.

That’s one more point to team USA, and the American crowd are going wild.

Sadly, there’s no coming back from a two-nil position for the Australian market. At this point, the best it can do is salvage a little self-respect—which brings us to valuations.

Match 3: Valuations

With the mention of valuations, the Aussie supporters are waking up. There’s a feeling in the air that the local market can win a battle on this front.

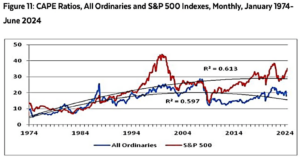

To the data … if we compare the CAPE valuation ratio (the cyclically adjusted P/E of the market), we can see that the S&P 500 and the All Ords were running neck and neck prior to the GFC. But then everything changed. Since the GFC, the US market has become unusually expensive with a CAPE ratio of over 35x, while the Australian market is languishing at just over half that valuation.

Source: Leithner & Co

OK, we get it. American stocks are much more expensive than Australian stocks because their EPS growth has trounced their Aussie counterparts. But a valuation of almost double the Australian market feels like a step too far. We can arguably surmise that the Australian market is on the cheap side, while the US market is on the expensive side. It’s an opinion rather than a fact, but we’re giving the point to the Australian market.

So the local market is on the board with a win, although it’s too late to salvage the match.

It’s not stopping Aussie investors from jumping to their feet. Maybe some of them will invest more in the local market in recognition of the value on offer.

Team USA has it … for now

There you have it, folks. The local market fought hard and honourably against a world champion team and lost.

However, there were valuable lessons learnt by the local team, not least of which is that EPS growth is what matters most to investors, and buybacks make a big difference over the long term. Hopefully the Australian corporate world is also taking note.

All being well, the next time these two heavyweight nations come head-to-head, the Australian team will put in a better showing on the EPS growth side of things. That alone is likely to be enough to inspire a narrowing of the vast valuation gap between these two countries.

Originally published on InvestmentMarkets.