By Simon Turner, Head of Content, InvestmentMarkets

31 July, 2024

As so many investors learn the hard way: markets often take the stairs up and the elevator down. It’s the same with the value of portfolios that were created to fund a certain level of retirement: a few missteps can quickly erode decades of saving and hard work.

Of course, market volatility is part of the game which is to be expected and navigated. But there are also a few mistakes investors often make which may be preventing you from living the retirement of your dreams.

Avoiding these six mistakes may be the difference that makes the difference in your twilight years.

Mistake #1 Being too conservative

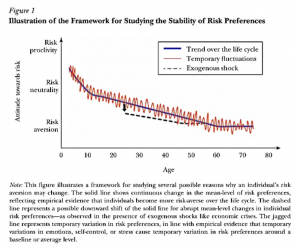

As investors get older, it’s common for them to become more risk averse. As shown below, there’s a strong correlation between age and risk aversion.

Source: Harvest

It’s easy to understand why is the case.

When picturing the retirement of their dreams, most investors have in mind predictable income streams, capital protection, and most importantly, peace of mind. So they often start as they mean to finish: by investing in the type of conservative assets they picture they’ll need in retirement.

This is generally a big mistake.

By positioning yourself too far down the risk curve, you’re unlikely to achieve the investment goals you need to fund your retirement.

The other issue with this risk averse mind-set is that often the more conservative, defensive asset classes like bonds are more volatile (read: risky) than investors expected at the time of investment.

The performance of global bonds since the pandemic is a case in point. If you’d been overweight bonds since then, you’d probably be sitting on negative returns whilst global equities have had an historic run.

Remember: the true cost of being too conservative includes the opportunity cost of missing out on the returns generated by the (perceived) higher risk asset classes.

Mistake #2 Ignoring the effects of inflation

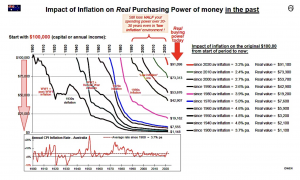

Ignoring the effects of inflation has cost many retirees the freedom they dreamt of.

Have you ever thought about what your money will be worth in the future?

Here’s the sobering truth … $100,000 will be worth only $28,400 in fifty years assuming a 2.5% p.a. inflation rate.

The numbers are even more upsetting at higher inflation rates: at 5% p.a. inflation, $100,000 is worth only $8,300 in fifty years.

You may be thinking this is a theoretical example. But the real data for Australia is just as shocking.

Let that sink in: the average Australian inflation rate since 1970 has been 5% p.a.—so $100,000 in 1970 has eroded to only $7,600 of present day value.

Suffice to say, the buying power of your retirement funds will be measured in the value of dollars when you retire. That means you need to ensure your investment portfolio is sufficiently exposed to growth assets with inflation protecting attributes. For example: equities, property, real assets, and private equity.

Equally, ensuring your portfolio is not too overweight assets without inflation protection attributes such as bonds (without inflation linking) is an important part of preparing to navigate future inflation.

Mistake #3 Trying to time the market

In a digital age when trading is as easy as picking up your phone and clicking on sell, it’s tempting to time the market.

This is a mistake.

Some investors time the market well some of the time. The problem is they’ll often sell ahead of a correction and then they’ll be left on the side-lines awaiting lower prices when the market bounces and continues in the ascendancy.

It’s almost impossible, even for professional traders, to consistently buy market lows and sell market highs.

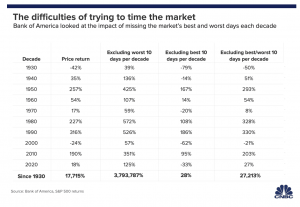

In addition, by trading in and out of the market you risk not being invested during the market’s strongest days. As shown below, that has a hugely detrimental impact on your potential returns.

Let’s not even get started on the wealth-eroding impact of capital gains tax which needs to be paid when you realise a gain.

So the most prudent strategy for most investors is to accept that there will be volatility along the way, and hold for the long term.

Mistake #4 Paying excessive fees

Investing in active and passive funds makes sense for a lot of investors. It’s a convenient way of ensuring your funds are managed professionally by an expert who’s focused on the job day in, day out.

However, it’s a mistake to pay too much in fund management fees.

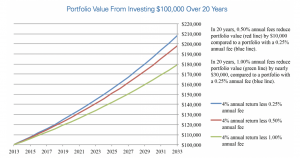

For example, the difference between a management fee of 1% p.a. and 0.25% p.a. is $30,000 on a $100,000 portfolio invested over 20 years.

Source: SEC

A 0.75% p.a. difference in annual management fees may not sound like a lot, but when you think about it as saving 30% of your initial portfolio value over 20 years, you’ll be more focused on not over-paying.

Make sure you do your research before investing in all managed funds to ensure you’re paying a competitive fee.

Mistake #5 Too much of a home country bias

Most Australian investors have a high weighting in Australian funds and stocks.

It’s not only because it’s more comfortable to invest locally. By understanding the local investment opportunities better than the global sphere, it’s tempting for investors to believe they can generate better risk-adjusted returns in the Australian market.

That’s generally a mistake.

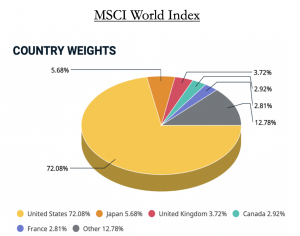

Australia represents only 2% of the MSCI World Index, so if you’re mainly focused on the Australian market that means you’re not focused on the 98% of investment opportunities located offshore.

MSCI World Index

Source: MSCI

There are also some noteworthy limitations in the Australian equity market.

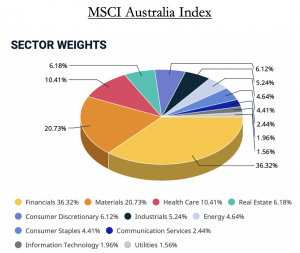

One of the glaring ones is the high weighting in financials and materials, which comprise 36.3% and 20.7% of the MSCI Australia respectively. The financial sector is known as an income-generating asset class but its growth prospects aren’t generally regarded as stellar, and the resources sector is known for its extreme cyclicality.

MSCI Australia Index

Source: MSCI

The opportunities across the global market are much broader than those available in the Australian market.

Don’t miss out by being too focused on the local opportunity set.

Mistake #6 Listening to bad advice

There’s a lot of bad financial advice available if you open your ears to everyone who believes they’re an expert. That includes the media, friends, even family.

The reality is good financial advice is often regarded as obvious and unexciting, so many investors prefer to follow more exciting pathways toward their dreams of wealth.

This is a mistake.

Focus on listening to and learning from successful investors who’ve been there and done that—and do your best to block out the noise.

In the digitally connected world in which we live, this may be the hardest mistake to avoid. But it’s a powerful means of remaining on track to achieve the retirement of your dreams.

Learn from others’ mistakes

Small changes lead to dramatic results over the long term.

All six of these mistakes are easy to avoid with some forethought and planning. You may be thankful you did when you’re enjoying your retirement without the financial stress so many people never escape from.

Originally published on InvestmentMarkets