By Annabelle Dickson, Content Marketing Manager, Betashares

Tuesday, 10 September, 2024

Building a multi-asset portfolio with ETFs

Disclaimer: The content of this article is provided for informational purposes only. It does not constitute, and should not be interpreted as, a recommendation or endorsement of any particular product or service. Readers are encouraged to conduct their own research and exercise their own judgment when making purchasing decisions. Sharesight shall not be held responsible for any consequences resulting from reliance on the information provided within this article.

The late Harry Markowitz, a giant in modern finance, famously said, “Diversification is the only free lunch in investing.”1 This timeless wisdom remains central to successful portfolio management.

Markowitz’s groundbreaking work on modern portfolio theory showed diversification could reduce investment risk while improving returns.2 In today’s often volatile market, this principle is more relevant than ever.

Exchange-traded funds (ETFs) have emerged as a cornerstone of modern investment strategies. By offering a cost-effective and flexible way to access a wide range of assets, ETFs empower investors to construct diversified portfolios aligned with their risk tolerance and financial objectives.

The importance of asset allocation

Asset allocation is the strategic distribution of investments across different asset classes, such as equities, bonds, commodities, cash and property. A well-planned asset allocation strategy is designed to reduce risk by balancing assets that typically do not move in tandem.

For example, Australian and global shares have historically had a low correlation with gold.2 By including both in a portfolio, an investor can potentially cushion the impact of a downturn in one sector with gains in another.

Source: World Gold Council. Calculated over one-year periods with weekly return frequency. Data as at 16 August 2024.

However, determining the right asset allocation isn’t a one-time exercise. It requires continuous monitoring and rebalancing to adjust for market changes and ensure the portfolio remains aligned with the investor’s goals. This disciplined approach is essential for managing risk, especially in volatile markets.

ETFs: The building blocks of multi-asset portfolios

Markowitz’s work in the 1950s highlighted that the combination of assets is more important than the selection of individual stocks and securities.

This insight has contributed to the growing popularity of funds, including ETFs, as preferred instruments for building diversified portfolios. ETFs provide exposure to a broad array of asset classes, sectors, and geographies, all through a single trade.

Here’s how ETFs can be used to construct a multi-asset portfolio:

1. Equities

Equities are typically the growth engine of a portfolio, offering the potential for higher returns. However, they also come with higher risk. To mitigate this, investors can diversify their equity exposure across different markets and sectors.

Australian shares have historically offered a mix of growth and income, with the added benefit of franking credits.3

Exposure to Australian shares can be achieved with a low cost ETF providing exposure to 200 of the largest listed Australian companies.

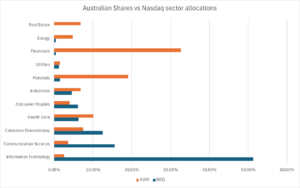

- International equities allow Australian investors to diversify outside their home market, while also offsetting the sector skews seen in Australian shares (see graph below). The companies in the Nasdaq 100 Index tend to be more heavily exposed to information technology, a high-growth sector under-represented on the ASX. An investor who combines the two via an ETF such as Betashares Nasdaq 100 ETF (ASX: NDQ) could create an equity exposure that is more diversified.

- All-in-one ETFs allow investors to hand the asset allocation decisions to professionals. Diversified ETFs like Betashares Diversified All Growth ETF (ASX: DHHF) offer exposure to a portfolio of equities that covers Australia, the US, and the rest of the world. A simple, straightforward option for those who wish to take a “set and forget” approach to investing.

Source: Betashares. As of 16 August 2024. Total weights may not add up to 100% due to rounding or immateriality. Holdings, weights and values are subject to change.

2. Fixed income

Fixed income brings stability to a portfolio, serving as a counterbalance to the risk of equities. This asset class is valued for its ability to provide predictable income and typically lower volatility compared to shares.

- Corporate bonds offer attractive levels of income through exposure to high-quality corporate debt, but with lower risk compared to equities. These securities were once the domain of sophisticated and professional investors, everyday investors can now easily access exposure to a portfolio of senior, fixed-rate, investment grade Australian corporate bonds through ETFs.

- Government bonds provide investors with the opportunity to invest in debt issued by the federal government, widely regarded as low-risk, particularly given Australia’s top-tier credit rating.4 Investors can gain exposure to Australian government bonds issued by federal and state governments with ETFs.

3. Commodities

Commodities such as gold and oil add another layer of diversification, often moving independently of equities and bonds.

- Gold is traditionally considered a ‘safe haven’ asset, and as shown in the chart earlier, it tends to perform well during market turbulence. Adding gold to your portfolio is easier than ever, with ETFs such as Betashares Gold Bullion ETF – Currency Hedged (ASX: QAU) providing exposure to physical gold bullion.

- Oil has historically shown a low correlation to other major asset classes, allowing investors to further diversify their portfolio. ETFs can offer exposure to the price of crude oil futures, providing an opportunity to benefit from movements in the energy market.

4. Cash and money markets

Holding cash or near-cash assets is crucial for liquidity and stability, especially in uncertain times.

- Cash provides high capital stability and attractive income depending on interest rates, and ETFs have broadened access to money market securities, allowing retail investors to tap into low-risk debt instruments beyond traditional cash, such as certificates of deposit, floating rate notes, and commercial paper. Betashares Australian High Interest Cash ETF (ASX: AAA) for example, simplifies cash allocations for Australian investors, eliminating the need to open a bank account, lock funds in a term deposit, or chase short-term promotional bank rates.

Hypothetical multi-asset portfolios

Now that we’ve explored how ETFs can offer targeted exposure to specific asset classes, how can we assemble the pieces together to match different risk profiles?

Every investor’s situation, risk tolerance, and preferences are unique, but the following are illustrative examples of how investors — whether prioritising capital preservation or seeking growth — might use ETFs to implement their asset allocation.

1. Conservative investor

This investor prioritises capital preservation and steady income, with limited exposure to equities.

Example allocation could include:

- 30% equities

- 50% bonds

- 10% commodities

- 10% cash.

2. Balanced investor

A balanced investor seeks a mix of income and growth, with moderate risk exposure.

Example allocation could include:

- 50% equities

- 30% bonds

- 10% commodities

- 10% cash.

3. Growth investor

Focused on maximising returns, this investor is willing to take on higher risk with a significant allocation to equities.

Example allocation could include:

- 70% equities

- 15% bonds

- 10% commodities

- 5% cash.

Leveraging Sharesight’s tools for portfolio analysis

To optimise these multi-asset portfolios, investors can use Sharesight’s portfolio tracking tools, such as the diversity report. This report offers a holistic breakdown of an individual or family’s asset allocation, including detailed weightings across various assets beyond those typically reported by share trading platforms.

For instance, a couple could see how their combined investments in stocks are distributed across different equity markets, weightings of cash in different currencies, and the proportion invested in property relative to their total wealth — insights often overlooked by traditional platforms.

Sharesight’s tools also allow investors to accurately track total returns of ETFs (including capital gains, dividends and franking credits), compare performance against benchmarks, and evaluate the overall risk-return profile of their portfolio. This comprehensive analysis is crucial for maintaining a well-diversified portfolio.

Conclusion

Markowitz’s work underscored the significance of diversification and the importance of focusing on a portfolio’s asset allocation. Subsequent studies have confirmed that asset allocation accounts for approximately 90% of the variability in investment returns over time.

ETFs simplify the process of achieving diversification and managing risk, while tools like Sharesight offer detailed, real-time insights into asset weightings. This comprehensive view helps investors ensure that their diversification strategies are tailored to their individual needs and goals.

Track your ETFs with Sharesight

With Sharesight’s portfolio tracker you can track the performance of your ETFs alongside the rest of your investments, including dividends, currency fluctuations, diversification, tax and more. Sign up for free to start tracking your performance today.

With Sharesight’s portfolio tracker you can track the performance of your ETFs alongside the rest of your investments, including dividends, currency fluctuations, diversification, tax and more. Sign up for free to start tracking your performance today.

Investing involves risk. The value of an investment and income distributions can go down as well as up. An investment in a Betashares Fund should only be considered as a part of a broader portfolio, taking into account your particular circumstances, including your tolerance for risk. For more information on risks and other features of each Betashares Fund, please see the Product Disclosure Statement and Target Market Determination, both available at betashares.com.au.

This article is brought to you by Sharesight, a proud partner of the Australian Shareholders’ Association.