By Prof. Matthew Pinnuck (The University of Melbourne), Dr Mark Wallis (The University of Queensland), Amir Ghandar FCA (Chartered Accountants Australia and New Zealand (CAANZ)), and Masood Mehmood FCCA, CA (CAANZ), on 20 September 2022

Key Audit Matters

Authors: Prof. Matt Pinnuck, Professor of Financial Accounting, The University of Melbourne; Dr Mark Wallis, Lecturer School of Business, The University of Queensland; Amir Ghandar FCA, Leader, Reporting & Assurance, Chartered Accountants Australia and New Zealand (CAANZ); and Masood Mehmood FCCA, CA, Senior Policy Advocate, Reporting and Assurance, CAANZ on behalf of the Australian Shareholders Association.

Since reporting periods commencing 15 December 2016, Key Audit Matters have been required to be included in the audit reports of listed entities. ASA company monitors value the greater insight into the conduct of the audit, and the opportunity to ask more specific questions of the auditor or Chair of the Audit Committee. This insight provides information about Key Audit Matters in the FY21 audit and annual reports of ASX listed companies which we (ASA) hope will lead readers to seek out Annual Reports and the Audit Reports within them.

Key Audit Matters Auditing Standard

Under Auditing Standard ASA 701 the company auditor is required to communicate in the audit report key audit matters – those matters that, in the auditor’s professional judgement, were of most significance in the audit of the financial report of the current period. Examples could include for example assessment of asset impairment and the accuracy and completeness of revenue recognition.

This report documents the main statistical facts regarding the frequency and nature of the reporting of Key Audit Matters (KAMs) in the Audit Reports of Australian ASX listed companies that issued financial statements in 2021. [1]

The main summary points are tabulated below.

How many KAMs are usually reported?

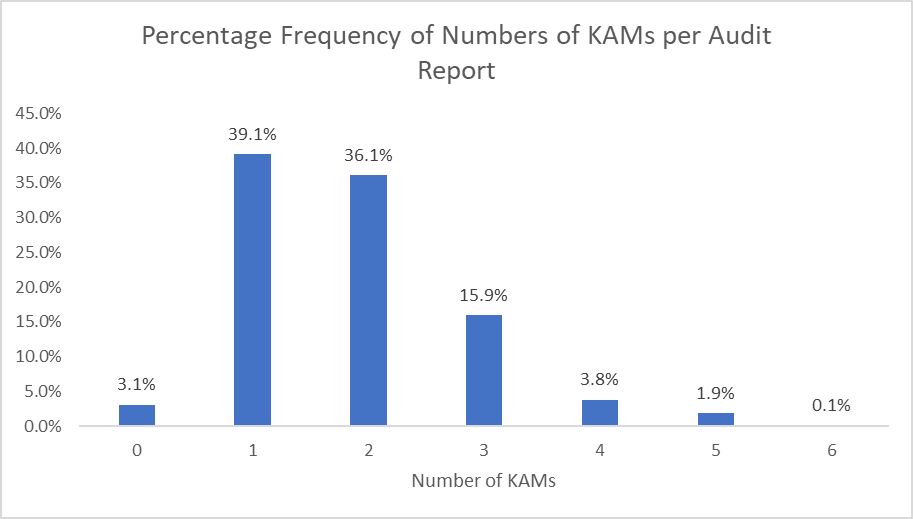

The Figure below reports the number of KAMs per audit report. Main points:

• Overall auditors report a mean of 1.84 KAMs per audit report.

• The number of KAMs in an audit report range from a low of 0 [2] through to the maximum of 6.

• The distribution of the number of KAMs is tightly clustered around the mean with 39% of audit reports having 1 KAM and 36% of audit reports having 2 KAMs. There are very few audit reports with 0 KAMs (3%) or 4 or more KAMs (6%)

[1] This report is partly based on the KAM Insights 2021 report produced by CAANZ-UoM-UQ

[2] Under ASA 701 paragraph 16, an auditor can include no key audit matters if none arise during the audit or if the only key audit matters relate to circumstances that lead to a modified audit opinion or adverse going concern opinion.

Which Companies Report the Least and Most KAMs?

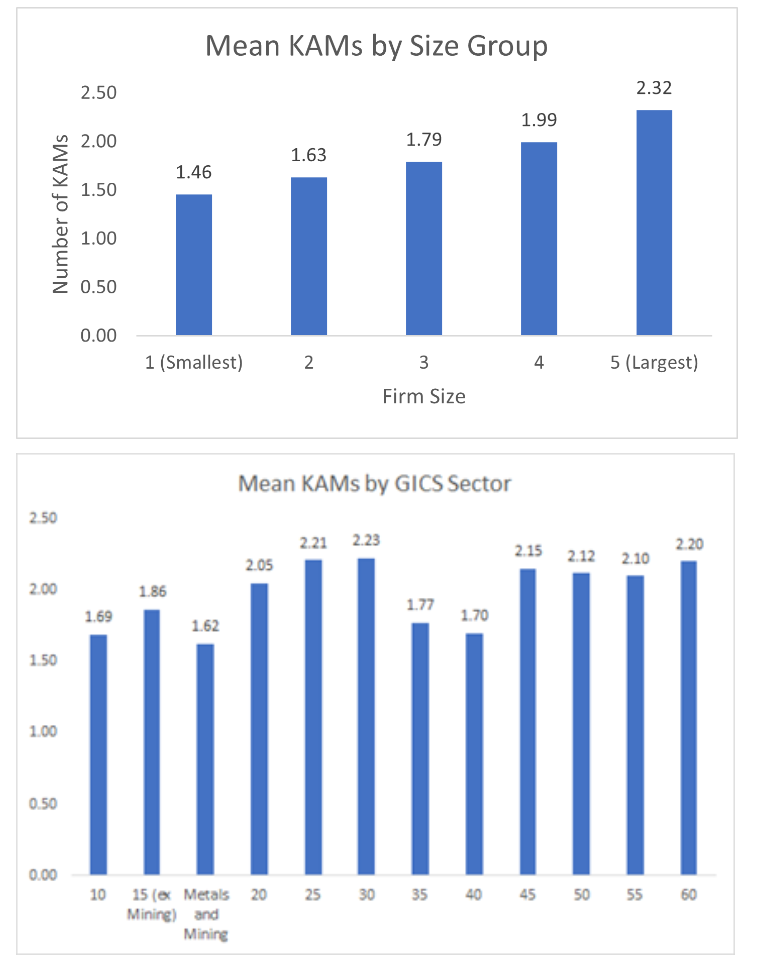

- The number of KAMs per audit report varies significantly as a positive function of the size of the company. The average number of KAMs for large companies is 2.32 compared to 1.46 for small companies.

- As can be seen in the Figure below the number of KAMs per audit report caries across industry sectors.[3] The industry with lowest number of KAMs is Metals & Mining (average = 1.62 KAMs) and highest Consumer Staples (average = 2.23 KAMs).

[3] We classify industries using the two-digit MSCI/S&P Global Industrial Classification (GICS) Standard codes. Metals and Mining (GICS Industry 151040) is separated from GICS Sector 15 due to the large number of mining companies in the Australian market.

What subject matters are the KAMs describing?

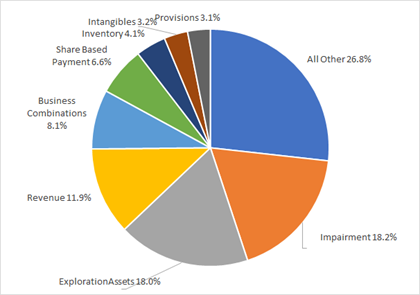

The Figure below reports the frequency of KAMS by subject matter area. Overall, we have classified 54 distinct KAM subject matters areas implying there is a broad range of different areas that are been identified as being of most significance in the audit of the financial report.

• These subject matter areas can be classified into a set of 8 subject areas that are most frequent and account 73% of all KAMs and another set of 46 areas that are infrequent and account for the remaining 27% of KAMs.

• The most frequent KAM subject matter was Impairments representing 18% of all KAMs. The next most frequent areas in order were: Exploration Assets (18%); Revenue (12%); Business Combinations (8%); Share Based Payment (7%); Inventory (4%); Intangibles (3%) and Provisions (3%).

• There is a large and diverse number of less frequent areas. Example include: Information Technology which usually involved implementation of a new IT system, Fraud Risk due to risk of fraud in recognition of revenue, Related Party Transactions and Funding & Liquidity.

[4] The Impairment Category includes impairments regarding all assets except those associated with an exploration and Evaluation Asset. The Exploration and Evaluation asset category includes all subject matters associated with this asset including impairments.

Which large companies have 4 or more KAMs?

The large Australian companies that had 4 or more KAMs include Altium, Ardent Leisure, Bravura Solutions, Decmil Group, Elanor Investors Group, Elders, Electro Optic Systems, Flight Centre, MMA Offshore, MNF Group, Norther Start Resources, Orica, Origen Energy, Premier Investments, Qantas, Resolute Mining, Seek, Select Harvest, Super Retail Group, The Citadel Group, TPG Telecom, Viva Leisure, Wisetech Global.

Impairments and Revenue

Impairments and Revenue are two subject matter areas that have a significant number of KAMs. We provide insight into the typical frequency and magnitude of impairments and discuss some of the reasons mentioned by auditors as to why revenue was a significant audit matter.

Impairments

A significant source of estimation uncertainty is impairment testing of goodwill.

Some significant patterns in regard to goodwill impairment are:

• Approximately 20% of firms impair goodwill every year however the frequency varies significantly across sectors. In the large-firm portfolio the Metals and Mining sector has the highest frequency of impairments (40% of firms per year) and Consumer Discretionary the lowest frequency of impairment (8% of the firm per year)

• The median magnitude of goodwill impairment is a write-down of goodwill value by 18% however this magnitude varies substantially across sectors. The Metals and Mining sector has the highest write-down of 51% and the Utilities sector the lowest of 0.90%.

• The distribution of the magnitude of impairments is highly right skewed with a significant minority of firms recognising very large impairments. For example, in the Consumer Discretionary the median write-down is 23.4% however the write-down at the 75th percentile is 63.7%. This implies that 25% of firms in this sector have a write-downs of greater than 63.7%.

Revenue

In general the main reason why revenue was considered a key audit matter by auditors was because of the significance of the magnitude of revenue to the financial statements. The second main reason was because of the judgement involved in applying the relevant accounting standard (AASB 15: ‘Revenue from Contracts with Customers’) which requires the application of a five-step model to recognise revenue. This five-step model required a number of estimates and judgements to be made by management in order to determine the point at which performance obligations are met and revenue can be recognised. The most frequently cited areas of judgement are:

• The recognition and measurement of rebates and promotional allowance (‘variable consideration’)

• Varying contract arrangements across customers with different points in time when control of the asset is transferred to the customer

• Recognition of construction revenue due to judgment involved in determination of stage of completion and measurement of progress towards satisfaction of performance obligations

Some illustrative examples:

Variable Consideration

CELLNET GROUP LTD

“Revenue is recognised net of estimated incentives, rebates and expected returns as prescribed under AASB 15 Revenue from Contracts with Customers. Rebate and incentive arrangements offered by the Group vary and are customer specific. These obligations are established either in contract or through principal of constructive obligation based on customary business practice, and the associated refund liabilities are estimated based on past practice, sales volumes and customer claim history. The expected reversal of sales through customers exercising their right of return is estimated based on historical rates of return. Due to the variety of contractual terms with customers and the degree of management judgement involved, the estimation of variable consideration in respect of these items is considered to be complex. There is a risk that revenue could be misstated due to the level of estimation and judgement required in accounting for these obligations. As such, we considered revenue recognition to be a key audit matter”

Varying and Multiple Contract Arrangement with Customers

TECHNOLOGY ONE LTD

The Group has the following revenue streams: ► SaaS fees; ► Annual licence fees; ► Initial licence fees; and ► Consulting services The Group contracts with its customers using written contracts which often include a number of products and services (separately identifiable components). Revenue recognition for these contracts was considered to be a key audit matter due to the complexity of contracts and the judgement required to allocate revenue amongst the respective performance obligations. Note 1(d) to the financial statements details the Group’s revenue streams and the associated accounting policies. Revenue is disclosed in Note 5, associated assets in Note 9 and Note 10 and associated liabilities in Note 16.

Methodology

We sampled the full population of ASX listed companies with a financial year-end from 31 December 2020 to 30 September 2021. Financial reports could not be obtained for some companies for reasons such as late filing, suspension and delisting. The final sample is 1,400 companies.

We classified the KAMs into subject matter categories based on three broad decision rules. First, if the subject matter was not an impairment and related to a specific primary financial statement account (e.g. Revenue, Receivables, Inventory, Provisions) then that account was the category. Second, we had categories for any KAM subject that related to impairments, exploration and evaluation, and business combinations. The Impairment Category includes impairments in regard to all assets except those associated with an Exploration and Evaluation Asset. The Exploration and Evaluation asset category includes all subject matters associated with this asset including impairments. Finally, we had a range of categories for KAM subject matters that were relevant to the audit that may not directly affect a specific financial statement account such as information technology due to implementation of enterprise resource systems.

[5] In some tables the number of companies is somewhat lower due to data requirements.