By Simon Turner, Head of Content, InvestmentMarkets

23 August, 2024

Cracking the asset allocation conundrum

It’s no exaggeration that asset allocation is the cornerstone of almost all successful investment strategies. In Tony Robbins’ words, ‘Asset allocation, where to park your money and how to divide it up is the single most important skill of a successful investor.’

Getting your asset allocation right tends to look simple in hindsight, but can be challenging in the heat of battle. With performance in mind, we delve into the key asset allocation issues investors should be considering below.

Why asset allocation matters

According to a study by Brinson, Singer, and Beebower, asset allocation, rather than stock selection, is the primary driver of portfolio performance and accounts for 93.6% of returns.

You read that right. 93.6% of your investment returns are likely to come from your asset allocation decisions.

So if you want your portfolio to generate strong risk-adjusted returns you’re going to need to get your asset allocation right.

This begs the question: how much focus have you been giving to your asset allocation?

If you’re like most investors, probably not enough.

The optimal starting point

There are two basic building blocks of making the optimal asset allocation decision:

- Your investment plan – Your asset allocation should align with your investment goals, time horizon, and risk appetite as detailed in your investment plan. Whether you devise this with an adviser or by yourself, your investment plan should reflect your personal circumstances, and you should be prepared to commit to following it over the long term.

- The over-riding assumption that the future is unknown – Many investors believe they know what’s coming. But the truth is no one does. Creating an asset allocation plan which reflects this inconvenient truth is generally a powerful starting point. Ray Dalio said it well: ‘You should have a strategic asset allocation mix that assumes that you don’t know what the future is going to hold.’

Setting expectations: risk vs return

In general, asset allocation aims to balance the expected risk and return of alternative asset classes with a sufficient degree of diversification to achieve an investor’s long term goals.

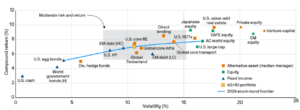

As shown below, the lower risk asset classes like cash and global government bonds have tended to generate the lowest backward-looking returns, whereas the higher risk asset classes like venture capital and emerging markets equity have tended to generate the highest.

USD stock-bond frontier vs. median manager return forecasts (by asset class/strategy)

Source: JP Morgan

In a perfect financial world, this relationship between risk and return would be a straight line with minimal deviation from the line. But the financial markets aren’t a perfect world. There are outliers in both directions.

For example, Japanese equities have generated returns above the level implied by their risk profile, and emerging markets debt has generated returns below the level implied by its risk profile.

This is useful information for asset allocation decisions since investors are generally aiming to maximize their risk-adjusted returns by being overweight the asset classes which are positioned to generate an attractive return per unit of risk.

Know thyself

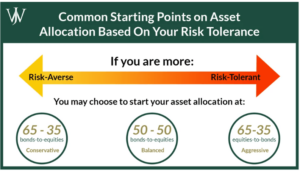

Historically, financial advisers have generally categorised investors as aggressive, conservative, or balanced.

Aggressive investors are generally younger investors who are prepared to take on more risk to achieve higher returns. In athletics terms, these investors are sprinters, and generally have a lot of exposure to growth assets like equities, private equity, and property.

Conservative investors are generally older investors who are risk averse and defensive of their net worth. In athletics terms, these investors are marathon runners, and generally have a lot of exposure to bonds, gold, and other defensive asset classes.

Balanced investors are a balance of aggressive and conservative investors. In athletics terms, these investors are middle distance runners with all-weather, diversified portfolios.

Here are some common asset allocation starting points for these three types of investors.

Source: Willis Johnson

Important tip: many investors allocate their capital in a manner that reflects less risk than is necessary to achieve their long term investment goals. In other words, they deviate from what their investment plan needs them to do. Make sure your asset allocation matches your investment plan by taking on the required amount of risk.

Father time has a role to play

One of the more misunderstood aspects of asset allocation is the way markets change over time.

The Callan Institute investigated how model asset allocations have changed over the past thirty years to achieve a targeted annual return of 7% p.a.:

So unfortunately, investors have been forced to take on more risk over time to generate the same returns.

The key takeaway is that it’s challenging to decide upon one asset allocation that’s fit for purpose for many decades. Intermittently, asset allocation adjustments may be required to reflect current market conditions.

For example, now we’re in a higher interest rate environment, there’s a stronger case to be made for including bonds in most portfolios. But when interest rates were close to zero, investors weren’t being compensated for taking on the risk of investing in bonds. Things change.

Recent asset allocation trends

On that note, it’s worth keep an eye on recent asset allocation trends in the fund management world to ensure you’re making an informed decision…

Typical fund allocations have been rising in:

- Equities – Inflation protection is the name of the game. A higher equity allocation helps investors safeguard their portfolio’s purchasing power in case high inflation continues to remain a concern.

- Private credit – This is emerging as a compelling alternative to fixed income as private credit often offers more attractive risk-adjusted returns than are available in the public markets.

- Infrastructure – A defensive sector with inflation protection attributes.

- Absolute return / hedge funds – After the global equity bull market we’ve witnessed, many funds are diversifying into assets which are not tied with broader market movements. Absolute return funds have been benefitting.

Typical fund allocations have been falling in:

- Cash – With higher interest rates, the opportunity cost of holding cash has risen.

- Real estate – An interest rate sensitive sector which has suffered from rising rates in recent years.

- Private equity – With heightened interest rate risk, highly leveraged private market assets have been losing their appeal for some investors.

Some food for thought when you’re considering your own asset allocation.

But remember: your asset allocation is specific to your own circumstances, and should align with your investment plan.

Asset allocation: the unsung hero of superior investment performance

The next time you find yourself thinking long and hard about which stock or fund to invest in, it may be worth giving your asset allocation more thought and focus. It’s probably the one decision that will have the greatest impact on your future investment returns.

Originally published on InvestmentMarkets