Simon Turner, Head of Content, InvestmentMarkets

24 July, 2024

Daniel Drew once advised, ‘Anyone who plays the stock market not as an insider is like a man buying cows in the moonlight.’

Maybe you weren’t in the market for a cow but you get the picture.

Insider buying and selling typically provides useful context investors can use to help improve their performance. This makes intuitive sense. Insiders know more than average investors about the outlook for their businesses. Sticking with Mr Drew’s metaphor, they know what their cows look like in the daylight.

After global market rallies like the one we’ve just witnessed, insiders tend to be more bearish than most investors are. But interestingly, recent insider sentiment tells a different story. In this article, we shine a light on what insiders are telling us through the data.

Follow insiders toward better performance

Most research into insider trading data confirms it’s a valuable tool for investors to utilise.

It’s a common-held view that insider buys are more powerful investment signals than insider sells. After all, insiders only tend to buy when they believe the stock price is going up, whereas they’ll sell stock for a range of reasons. For example, a CEO may need cash for a house renovation.

The main scenario in which insider selling is generally regarded as a useful signal is when many insiders are dumping large volumes of stock within a short period of time.

Aerovate Therapeutics (NASDAQ: AVTE) is a recent example of this situation. Insiders were selling large amounts of the stock for many months before the company announced the failure of its late-stage pulmonary arterial hypertension trials. Needless to say, the market didn’t respond well to the news.

Source: Yahoo Finance

Investors who followed insiders to the exits would have saved almost all their capital if they’d heeded the warning signals in time.

The data that proves insider data is valuable

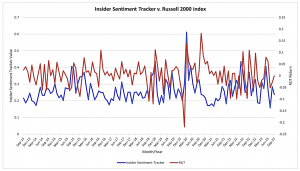

Insider Sentiment’s research confirms the value of insider sentiment data. In the chart below, their Insider Sentiment Tracker (the blue line) shows the portion of companies experiencing net insider buying, and the red line is the performance of the Russell 2000.

Source: Insider Sentiment

You’ll notice the Russell 2000 almost always follows the Insider Sentiment Tracker after a short lag. In other words, insiders are almost always one step ahead of the rest of the market.

Insider sentiment data is particularly useful at market extremities. For example, insiders were most bullish at the pandemic low in March 2020 with a 60% Insider Sentiment Tracker reading. In hindsight, that was the most compelling buying opportunity we’ve witnessed in recent years.

So the potential for investors to use insider sentiment to improve their performance is significant.

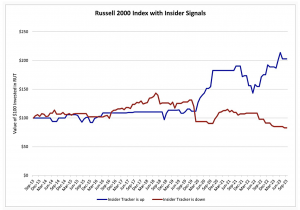

Insider Sentiment recently tested this theory. In the chart below, the blue line represents a portfolio invested in the Russell 2000 whenever insider sentiment was average (26%) or better. Whenever the sentiment tracker fell below 26%, the funds in that portfolio were moved into a non-interest bearing bank account. The red line is the opposite strategy: i.e. these funds were invested in the Russell 2000 whenever the insider tracker was 26% or below. When the blue line goes up following insiders is fruitful, and vice versa.

Source: Insider Sentiment

So the performance of the insider led portfolio blew the opposing strategy away. It’s proof that using insider sentiment as a guide is a strategy worthy of investors’ attention.

What insider sentiment is telling us right now

The latest insider sentiment data (from the US) is more bullish than the sharp rise in the stock market would ordinarily suggest is likely.

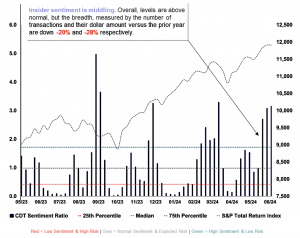

As shown below, CDT’s Capital Management’s current measure of insider sentiment is well above average, albeit with lower breadth than a year ago.

Source: CDT Capital Management

According to this measure, current insider sentiment is above normal suggesting market risk is on the low side.

Source: CDT Capital Management

If insiders are correct, as they tend to be, the current bullish insider sentiment suggests the US equity market may continue to lead global markets higher.

Insiders are bullish

Insiders en masse have excellent track records of buying and selling their companies’ stocks. So paying close attention to management buys and sells, and not buying your cows in the moonlight, offers the potential to improve your investment performance.

Right now, insiders are telling us that this US-led global bull market may have further to run. Time will tell.

Originally published on InvestmentMarkets