By Ankita Rai, InvestmentMarkets | Friday, 1 November 2024

The healthcare sector is back in focus, and for good reason. As the global economy slows and interest rates drop, investors looking for a safe haven are turning to the healthcare sector’s long-term growth potential.

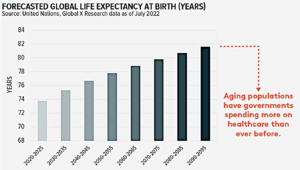

While breakthroughs in obesity treatments, advanced cancer therapies, and new cell technologies have long captured investors’ attention, the current economic landscape has made the sector even more attractive. The ageing population and rising healthcare spending are structural growth drivers which are independent of global economic conditions.

Key forces driving healthcare growth

The healthcare sector has been a story of two contrasting performances in recent years. On the one hand, pharmaceutical giants like Novo Nordisk and Eli Lilly have thrived in the weight-loss drug market, achieving solid gains of 15% and 57% respectively in 2024.

On the other hand, the broader biopharmaceutical and health tech industries have faced challenges due to a shift in investor focus towards high-growth sectors like AI and the realignment of healthcare supply and demand dynamics since the pandemic.

Additionally, persistently high interest rates have placed valuation pressure on long-duration investments, such as those in biotech.

Despite these headwinds, the long-term outlook for healthcare remains positive, driven by key trends such as the ageing global population, rising demand, and ongoing innovation, particularly in biotechnology therapies including vaccines and antibodies.

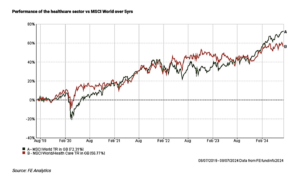

Historically, the healthcare sector has delivered solid returns for investors, although it has faced challenges from rising inflation. For the year ending July 8th, the MSCI World Health Care Index, which includes a significant portion of Eli Lilly and Novo Nordisk, returned 14.8%. However, this performance lagged behind the tech-heavy MSCI World Index, which rose 25.5%.

Similarly, the S&P/ASX 200 Health Care Index increased 5% in FY 2024 while the broader S&P/ASX 200 Index rose 7%, translating into underperformance versus the market.

Nonetheless, over the past five years, investing in healthcare has provided significant diversification benefits compared to the broader market, as illustrated in the chart below.

The long-term growth potential of healthcare is evident, as it currently accounts for 10.2% of global GDP and is expected to maintain that level. With the world’s GDP projected to reach $137 trillion by 2030, nearly $14 trillion will be spent on healthcare each year.

Emerging trends reshaping the healthcare landscape

With an ageing population—projected to be one in six people over 65 by 2050—and increasing rates of chronic diseases like diabetes and obesity, the demand for healthcare services is surging.

Source: GlobalX

Fast-emerging themes such as genomics and telemedicine are also reshaping the sector, fuelled by digitally savvy consumers and the rise of artificial intelligence to improve patient outcomes. In fact, the telemedicine and digital health market is expected to reach $787 billion by 2028.

Biotechnology is another area that is gaining momentum after emerging from a tough bear market. While established names like CSL and ResMed dominate the Australian market, promising companies such as Telix and Neuren are also making waves, particularly in oncology and rare diseases.

Furthermore, regulatory approvals are paving the way for innovation, with the FDA granting a record 73 new drugs last year.

With many healthcare stocks arguably still undervalued, particularly in biotech, investors can find compelling opportunities in the space.

ETFs and managed funds, like the Merchant Biotech Fund—which invests in a diversified portfolio of life science companies including biotechnology, pharmaceuticals, medical devices, medical data, information technology (e-health), and robotics—are showing strong returns and emphasising the potential for long-term growth in this dynamic sector. The fund finished the past financial year up more than 70%.

The SGH Medical Technology Fund is another compelling option, with investments in companies like CSL, ResMed, Pro Medicus, Cochlear, and Telix Pharmaceuticals. The fund mainly targets medical technology firms and achieved a net return of 19.6% over the last year.

Getting the right healthcare property exposure

Getting the right healthcare property exposure is also key. Healthcare real estate has been one of the top-performing sectors over the past two years, offering a compelling opportunity for income-focused investors seeking stability and diversification.

Healthcare is primarily non-discretionary, making it resilient against economic downturns. In addition, asset types like hospitals, medical centres, and aged care facilities benefit from government-backed funding, which accounts for about 60% of revenues. This support enables long-term leases, providing consistent income and resilience against economic downturns.

Managed funds can offer investors access to this scarce and defensive healthcare real estate asset class while securing attractive returns.

For example, the Centuria Healthcare Property Fund provides long-term capital growth by investing in healthcare assets with long-term leases. The RAM Australia Healthcare Opportunity Fund is another option that focuses on premium healthcare real estate assets in Australia. Through asset repositioning, the fund targets a range of development, value-add, and core-plus opportunities, aiming for total returns of 12-14% p.a.

Healthcare investment risks and rewards

Healthcare presents a unique combination of stability and growth, driven by demand and innovation. Ageing populations, rising healthcare spending, and the rapid pace of technological advancements provide a strong foundation for the sector’s long-term investment returns.

However, investing in healthcare also comes with its own risks. The process of bringing new drugs to market is long, expensive, and uncertain, with only a small percentage of drugs successfully passing clinical trials. Investors should remain mindful of the inherent risks, including the volatility associated with drug development and regulatory challenges.

With the right strategy and risk management, healthcare can be a rewarding sector that not only withstands uncertainty but its defensive nature allows it to thrive in a wide range of global economic scenarios.

Originally published on InvestmentMarkets.