By Fiona Balzer, Policy and Advocacy Manager, and Damien Straker, Advocacy Coordinator

7 October 2022

Possible changes to franked distributions where funded by capital raisings

As we communicated to members last week in our weekly member email, earlier this month, the Treasury released an exposure draft of the Treasury Laws Amendment (Measures for a later sitting) Bill 2022: Franked distributions funded by capital raisings (exposure draft).

According to its consultation page, these changes are an integrity measure that would “prevent the distribution of franking credits where a distribution to shareholders is funded by particular capital raising activities”.

The Government has released explanatory materials which go into more detail about why it is making these proposals. It is said not to be intended to capture usual dividend paying practice.

We have several concerns about the proposed legislation and its potential impact on retail shareholders, including:

- the retrospective nature of the Bill;

- the broadness and potential subjectivity of the tests that determine which transactions are captured; and

- the administrative and financial burden for individuals who inadvertently fall foul of the legislation and must amend tax returns potentially dating back six years.

We have lodged our submission which you can read here:

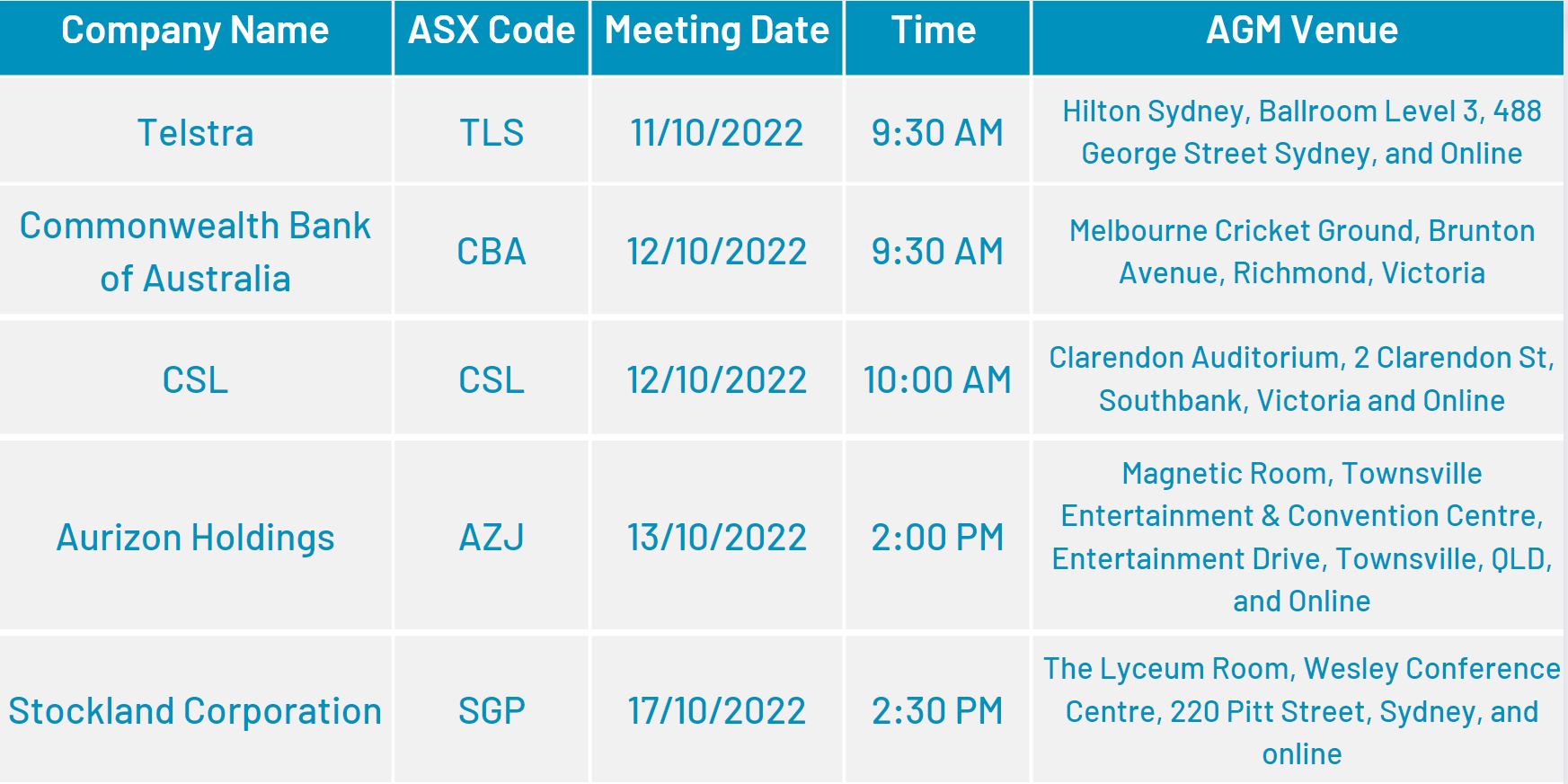

Upcoming company meetings

ASA will attend more than 30 AGMs in the week commencing 17 October, with 12 AGMs taking place on 20 October! We suggest you refer to the full list of upcoming AGMs here. Voting intention reports will be available approximately two weeks prior to the AGM date.

CSL (CSL) AGM

We are voting open proxies in favour of the resolutions at this AGM. CSL made some revisions to its remuneration structure in FY22.

- The addition of a second long-term Incentive (LTI) measure which aligns with ASA guidelines;

- An increase in the short-term Incentive (STI) maximum opportunity by a third; and

- Vesting of awards aggregated to a single point in three years’ time, rather than in three tranches over four years.

The reporting of the CEO’s actual take-home remuneration, as well as the target and maximum opportunity of each component is clearly disclosed. CSL provide a clear comparison of FY23 CEO remuneration with Paul Perreault’s global pharmaceutical/biotechnology industry peer group and explained the stated target for executive rewards toward the median of global peer groups. This flags further future increases in key management personnel remuneration of the order of 25%.

Read the full voting intentions report for CSL here

Stockland (SGP) AGM

In general, we don’t have too many concerns with Stockland and will support the resolutions to be put to the vote at the AGM. In our pre-AGM meeting we challenged them on the increase in the potential maximum of the CEO and long-term incentive remuneration and raised the need for some of the non-executive directors to lift their “skin in the game” above the minimum shareholding policy requirement of 40,000 securities. Directors Ms Conrad and Ms O’Reilly hold shares in excess of a year’s fees, while Mr Brindle, Ms Mckenzie and Mr Tindle are on track to match their fees. Chair Mr Pockett holds 50,000 shares and Messrs Newton and Stevens have been there for 6 and 7 years and are still sitting on a 40,000 shareholding.

The increase in executive remuneration is seen as a necessary incentive to achieve out performance but also to protect Stockland from losing key personnel as the company becomes more successful. It is aligned with shareholder expectations in that it is delivered in equity and will be measured against relative and absolute total shareholder return.

Read the full voting intentions report for Stockland here

Blackmores (BKL) AGM

We’re also supporting the resolutions at the Blackmores AGM. We are disappointed that the AGM is only in-person and not hybrid, excluding online shareholder engagement for those who cannot attend the meeting in Warriewood. The board was determined to return to normal as soon as possible and have an in person meeting especially as many shareholders live in NSW. Given all the changes in board and management over the last 3 years we agree that it will be good to return to Warriewood. They felt that the additional costs of a hybrid meeting were not justified, however at our request they will review this for future years.

Cochlear (COH) AGM

We will be supporting the resolutions but are yet to decide how we will be voting regarding the re-election of Yasmin Allen. She has served on the Board for 12 years, so it is unlikely we would consider her truly independent due to that tenure. Also, she seems to have a heavy workload, with 3 other Directorships of ASX companies plus at least 3 other Boards / advisory bodies.

Read the full voting intentions report for Cochlear here

Endeavour (EDV) AGM

This is Endeavour’s first year as a stand-alone S&P/ASX50 Index company and we wanted to question the board on a broad range of areas. There are areas where we felt they had not attained the right balance, such as the sufficient proportion of independent directors on the board, but many things that they have done well. Notwithstanding, the difficulties of COVID-19, floods, supply chain, and inflationary pressures, they have pressed forward with the renewal of stores, hotels, and gaming machines.

The board has been selected by Woolworths and the Bruce Mathieson Group (BMG) and ASA feels its heavily weighted to those shareholders. They are both significant shareholders with around 14% and 15% each. While it was understandable during the demerger it would be preferable to see this transition to a much greater proportion of independent directors going forward.

Read the full voting intentions report for Endeavour here

Transurban (TCL) AGM

Transurban received a first strike on remuneration report last year. As a result, they have implemented more transparent reporting of short-term incentive performance and realised CEO remuneration. They include clearer STI performance measures including the removal of individual measures and a downward discretionary modifier for non-financial measures. With the adoption of a 4-year performance period and disclosure of actual remuneration, Transurban’s remuneration structure meets the key ASA’s guidelines. ASA proposes to support the Remuneration Report and the other resolutions.

Read the full voting intentions report for Transurban here

Perpetual (PPT) AGM

The overriding issue that overshadowed the annual results announcement and presentation on 25 August 2022 is the acquisition of Pendal Group which was also announced the same day.

The ASA intends to vote undirected proxies in favour of the remuneration resolutions because there is no increase in fixed remuneration for the CEO, the grants are in line with the established remuneration arrangements voted in favour of last year, the overall improved financial performance of the company over the last two years and the successful integration of Trillium and Barrow Hanley into the organisation.

Read the full voting intentions report for Perpetual here

Credit Corp Group (CCP) AGM

ASA will be voting against the remuneration report this year. We object to the long-term incentive being allocated using a ‘fair value’ of the performance rights which inflate the number due to a steep discount to market value.

While LTI is intended to align the interests of executives and shareholders, the company policy of not requiring executives to retain a minimum shareholding in the company, results in most executives selling their shares upon vesting.

Read the full voting intentions report for Credit Corp here

Telstra (TLS) AGM Read the full voting intentions report for Telstra here

Commonwealth Bank (CBA) AGM Read the full voting intentions report for CBA here

Aurizon (AZJ) AGM Read the full voting intentions report for AZJ here

Treasury Estate Wines (TWE) AGM Read full voting intentions report for TWE here

Brambles (BXB) AGM Read the full voting intentions report for BXB here