AGM Season

We have 22 AGMs next week and 37 the following week. Voting intention reports are flowing in as the activity lifts again.

The report for AGL Energy’s AGM is now available. After interviewing the prospective independent shareholder-nominated directors and having the pre-AGM meeting, we will be voting against the remuneration report. We will determine our vote for the election of Christine Holman and John Pollaers at the AGM, and will vote undirected proxies for the other elections.

We are balancing the existing board’s concern about having too many directors and not being able to add any standout candidates who haven’t yet indicated they would join the board with the need for a high functioning board now. We encourage AGL shareholders to review the available information (there are many links in the report) and think about how the board and directors need to work together to bring about the best decision and strategy execution for the company.

Strike Count for ASA monitored companies

Company/Against vote on remuneration report

Santos 25.32%

Cleanaway 25.49%

ASX 30.52%

GUD 41.10%

Blackmores 43.35%

GUD joined the list of strikes. Feedback was a proxy advisor suggested the hurdles for EPS target in the MD’s LTI is not sufficiently challenging at 4% compounding over three years. We were swayed by the company considering it is a challenging target.

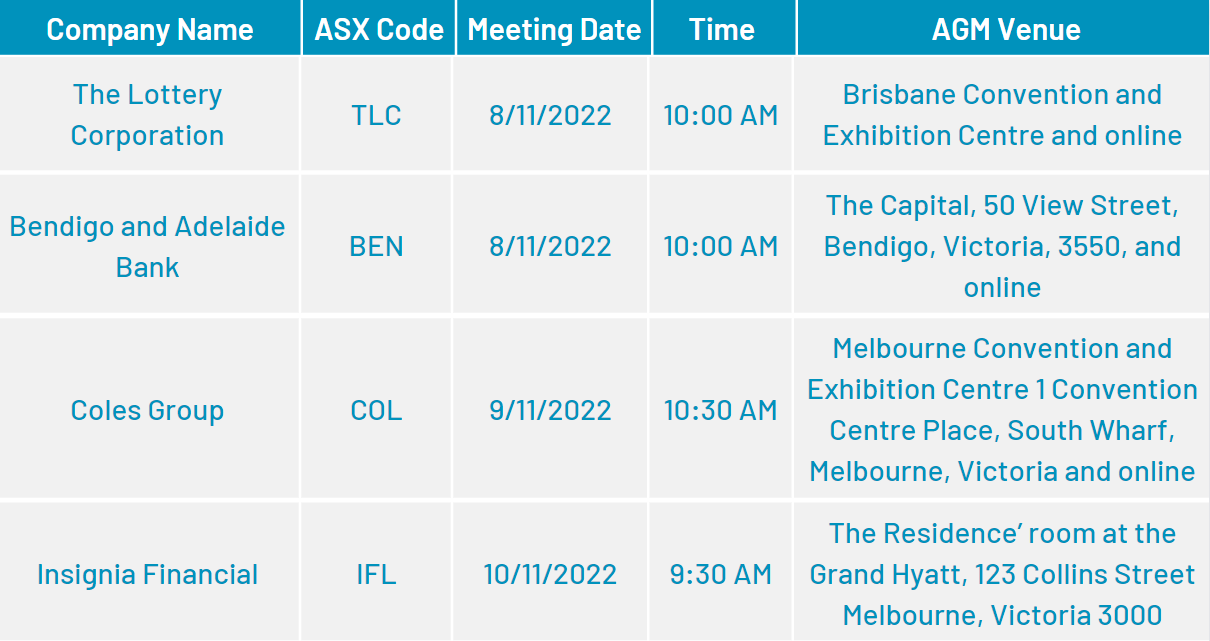

Upcoming company meetings

The full list of upcoming AGMs for the rest of the year can be viewed here. Voting intention reports will be available approximately two weeks prior to the AGM date, except where the pre-AGM meeting with directors has been delayed.

Ansell (ANN) AGM

We are voting open proxies against the remuneration report and grant to the CEO for the following reasons:

The Board’s decision to award retention benefits to two executives of one year’s base salary, awarded as equity over two years, on Mr Salmon’s appointment as CEO to ensure the stability and continuity of leadership of the Executive Team, with the only condition being their continuing service; AND the lack of any use of TSR (for example as a Gateway) and therefore allowing vesting of rights when shareholder returns are negative. In addition, the maximum CEO package payable is substantially above benchmarks for a company of its size, in large part because the maximum LTI is a very high multiple (2.8 times) of fixed remuneration.

Read the full voting intentions report for Ansell here

Simsmetal (SGM) AGM

While the profit looks great, with sales revenue increased 56.6% from last year to $9,265m and underlying NPAT increased 103.8% to $578.9m, the share price remains below where it was five years ago. We are voting against the remuneration report and grant of equity resolutions because ASA does not support the STI being paid fully cash, or cash awards for LTI measures, and three years is insufficient time for LTI projects to be effective. The single year period for measuring SSI, is not long term. Underlying EBIT should not be used to calculate awards. There is a lack of clarity on KMPs targets. The ASA considers that although some improvements will be made to the remuneration practices in FY23, we will evaluate the improvement when the information comes next year.

Read the full voting intentions report for Simsmetal here.

IGO (IGO) AGM

Sadly, when preparing these voting intentions, we have been advised of the death of IGO’s long-time CEO, Peter Bradford. We held Peter in the highest regard for his professionalism, his enthusiasm, and his commitment to preserving the planet. We recognised and respected his inspirational leadership. He will indeed be a huge loss to the mining and resources sectors, business at large, plus the communities with which he was involved. Against rem report and grant.

The company continues to assess the long-term incentive on a three-year appraisal period, which we believe to be too short. For a company of IGO’s size and status, we believe a 4-year LTI appraisal period is the minimum requirement and for this reason we will continue to vote against the remuneration report.

Apart for the LTI appraisal period, our other concerns with the remuneration structure are relatively minor, being that there is no mandatory cancelling of LTI vesting if TSR is negative (this being at board discretion) and that relative TSR allows vesting if IGO’s TSR is at the median of the comparator group – ASA prefers vesting to commence only if TSR is above the median of comparator companies.

Read the full voting intentions report for IGO here

SEEK (SEK) AGM

In recent years SEEK has, because of a remuneration strike in 2019 and further significant 17% against vote in 2020, tweaked its remuneration structure. It remains, however, sufficiently outside our guideline parameters on several fronts. The Equity Grants, a sort of STI, are not at risk, except following the departure of the KMP. We will vote open proxies in favour of directors and the increase in non-executive director’s total aggregate fees.

We are unable to support the remuneration report or approval of equity grants to the Managing Director/CEO as the structure remains sufficiently outside our guideline parameters on several fronts.

The Equity Grants, a sort of STI equivalent, are not at risk other than retention in the role, except following the departure of the KMP. Vesting rises linearly to 100% if the CAGR share price is 6% for the 3-year period, namely $28.29. The WSP does not include a financial hurdle or a comparison with peer companies (to test out-performance).

Read the full voting intentions report for SEEK here

In case you missed it

Bendigo & Adelaide Bank (BEN) AGM Read full voting intentions report for BEN here

The Lottery Corporation Limited (TLC) AGM Read full voting intentions report for TLC here

NRW Holdings (NWH) AGM Read full voting intentions report for NWH here

Newcrest Mining Limited (NCM) AGM Read full voting intentions report for NCM here

Coles (COL) AGM Read the full voting intentions report for Coles here

Nine Entertainment Group (NEC) AGM Read the full voting intentions report for NEC here

BHP Group (BHP) AGM Read the full voting intentions report for BHP here

Jumbo Interactive Limited (JIN) AGM Read the full voting intentions report for JIN here

Ansell Limited (ANN) AGM AGM Read the full voting intentions report for ANN here

Insignia Financial (IFL) AGM Read the full voting intentions report for Insignia Financial (the name was IOOF until December 2021)

Computershare Limited (CPU) AGM AGM Read the full voting intentions report for CPU here

Fonterra Shareholders’ Fund (FSF) AGM Read the full voting intentions report for FSF here

Allkem Limited (AKE) AGM Read the full voting intentions report for AKE here

Northern Star Resources (NST) AGM Read the full voting intentions report for NST here

Vicinity Centres (VCX) AGM Read the full voting intentions report for VCX here

Beach Energy Limited (BPT) AGM Read the full voting intentions report for BPT here

Medibank Private Limited (MPL) AGM Read the full voting intentions report for MPL here

Seven Group Holdings Limited (SVW) Read the full voting intentions report for SVW here

IGO Limited (IGO) AGM Read the full voting intentions report for IGO here

SEEK Limited (SEK) AGM Read the full voting intentions report for SEK here

Lendlease Group (LLC)AGM Read the full voting intentions report for LLC here

BlueScope Steel Limited AGM (BSL) Read the full voting intentions report for BSL here

Austal Limited (ASB) AGM Read the full voting intentions report for ASB here