By Cameron Gleeson, Senior Investment Strategist, Betashares

29 July, 2024

When starting with limited investable capital, achieving financial goals can seem a long way off. Betashares Wealth Builder ETFs can accelerate the accumulation process for investors who are comfortable with the risks associated with gearing, through a dollar-cost averaging (DCA) investment strategy, as described in this insights piece.

Of course, it’s important to remember that gearing magnifies both gains and losses and may not be a suitable strategy for all investors. Geared investments involve higher risk than non-geared investments.

What is your ‘ideal’ asset allocation?

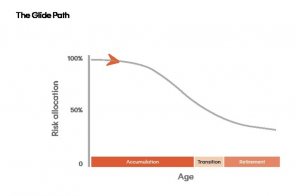

Common investment wisdom is that, as one ages, exposure to growth assets (e.g. equities) should be reduced and replaced with increasing allocations to defensive or low risk assets. This age-based asset allocation trajectory is commonly referred to as the ‘glide path’.

Under such an approach, a young investor would start with a portfolio of close to 100% growth assets. This would steadily decrease over time, so that by retirement their allocation to growth assets would be very low or close to zero.

The focus at the outset is on high growth, with the aim of ‘gliding’ towards a high level of portfolio stability in retirement.

In our view, there are reasons to challenge this simple ‘glide path’ framework, noting the following:

- Depending on an investor’s circumstances, it may not necessarily be appropriate to shift to a low-risk portfolio in retirement.

- Why does the investment journey have to start with 100% invested in risk assets? What is special about 100%? Why not start higher?

We will leave the discussion on asset allocation in retirement for another time and address the second point. What is so special about beginning with 100% growth assets for the young accumulator? Why not start higher?

How gearing could help

Many Australians are already familiar with the idea of gearing as an investment strategy, borrowing money to buy property or to invest in shares. Gearing allows you to gain greater exposure to growth assets than using your own capital alone would allow, and may in certain circumstances (depending on the underlying investments) also lead to more favourable tax outcomes. Some of the key ‘practical’ reasons for limiting growth asset exposure to 100% of invested capital may be related to risk tolerance and complexity associated with using most forms of investment borrowing.

Generally speaking:

- the higher the expected return, the higher the risk;

- applying for an investment loan in your own name (or on behalf of a trust or SMSF) can be an arduous process; and

- interest costs can be a significant drag on your overall return.

The Betashares Wealth Builder ETFs were designed with these considerations in mind:

- Gearing is internally managed within the funds, meaning all gearing obligations are met by the fund. No loan applications, no credit checks and no possibility of margin calls for investors.

- Institutional interest rates on borrowings are considerably lower than those available to individual investors, meaning the threshold to achieve positive returns is lower.

- Whilst gearing does magnify gains and losses, a ‘moderate’ level of gearing (30-40% for these funds), together with a diversified portfolio, could be considered for many investors with a long investment timeframe seeking to accelerate their growth potential.

The combination of gearing and DCA

Dollar cost averaging (DCA) provides an easy way for young accumulators with limited initial investable capital to seek to build long-term wealth.

Provided you invest consistently no matter where market levels are at, and that over the long run the market generally appreciates by more than your cost of borrowing, using a moderate amount of gearing together with a DCA approach could allow an investor to take full advantage of the market’s compounding power.

A hypothetical example: using DCA with a geared strategy

Let’s look at an example which seeks to illustrate the potential benefits of using a DCA approach in combination with a geared investment strategy. This example looks at simulated (hypothetical) total returns of a broad share market index over a 10-year period.

After returning 10% in year 1, the market falls by 50% in year 2 (for context, the S&P/ASX 200 Index fell by 35% during Covid and by 55% during the GFC), before recovering as per the chart below:

Hypothetical example provided for illustrative purposes only. It does not represent the actual returns of any share market or fund and does not take into account any fees and costs. Actual outcomes may differ materially. This information is not a recommendation or offer to make any investment or adopt any particular investment strategy. Simulated past performance is not indicative of future performance of any fund or strategy.

In this hypothetical example, from the start of year 1 to the end of year 10, the share market delivers a compound return of around 9.1% p.a. despite a very significant market drawdown early on.

If an investor had invested all their capital in a 10-year “buy and hold” strategy at the start of year 1, with or without employing gearing, the drawdown in year 2 would have significantly dented the value of their investment. Now let’s assume that, rather than committing all their capital on day 1 the investor, has $10,000 available to invest at the start of each year (so $100,000 in total), and their choices are to:

- Invest in the market without gearing; or

- Invest in the market using gearing with a Loan-to-Value (LVR) ratio of 33%

For simplicity, for the ungeared client, we assume no brokerage or management costs. For the geared client we assume that: (a) when each $10,000 contribution is made at the start of each year, their investment portfolio is rebalanced back to an LVR of 33%; (b) the interest rate on the borrowed funds is 5% p.a. throughout the 10 years; and (c) there are no other brokerage or management costs.

The chart below shows the growth in the investor’s capital over the 10-year period for each of the geared and ungeared DCA strategies.

Hypothetical example provided for illustrative purposes only. It does not represent the actual returns of any share market or fund and does not take into account any fees and costs. Actual outcomes may differ materially. This information is not a recommendation or offer to make any investment or adopt any particular investment strategy. Simulated past performance is not indicative of future performance of any fund or strategy.

In this hypothetical example, the market drawdown in year 2 impacts the geared strategy’s capital ($14,781 at the end of year 2) more than the ungeared strategy ($20,500 capital at the end of year 2). However, the geared strategy accelerates during the early stage recovery to draw level in year 4, and then deliver a material uplift in total investment return over the full 10-year period. The geared strategy would have grown the investor’s $100,000 total contributions to $305,960, versus $250,065 for the ungeared strategy.

Of course, in a market that generally declines over the comparison period, the geared strategy would be expected to underperform, with magnified losses, compared to an ungeared strategy. Also, the ability of the geared strategy to outperform an ungeared strategy will generally depend on the underlying investment generating total returns in excess of funding costs. Geared investing also comes with greater volatility than an equivalent ungeared strategy.

How a DCA approach helps an investor stay on track

Behavioural finance also shows that investor biases, like recency bias and loss avoidance, can have a large (and usually) negative impact on how we invest. A DCA approach can help to avoid any emotional decisions by consistently investing incremental amounts. Spreading out contributions avoids the risk of investing a large lump sum amount just before a severe market downturn occurs.

Consistently investing without having regard to market levels also helps to minimise the impact of bad market timing. When you invest regardless of whether markets are down or trending upwards, dollar cost averaging helps to avoid the difficulty of ‘timing the market’, which can provide more peace of mind during periods of heightened market volatility. That discipline of continuing to invest during and after a market fall has the potential to accelerate your recovery of capital.

We have written previously about the benefits of a DCA approach here.

In summary:

A geared investment strategy using a DCA approach has the potential to deliver significantly higher gains over the long term than using a DCA approach without gearing, but there are some important caveats:

- the market must generally appreciate by more than the cost of gearing over the relevant time period,

- the investor must consistently invest no matter where market levels are at, and

- the investor’s time horizon must be long enough such that they can continue to invest after any significant market drawdowns to ensure they benefit sufficiently from the recovery.

Betashares Wealth Builder ETFs provide accumulators who are comfortable with the risks associated with gearing with a powerful building block that could help to enhance long term wealth creation. The Betashares Wealth Builder range currently comprises two ETFs.

|

Betashares Wealth Builder Funds |

||

|

Exposure |

Australian equities |

Australian and global equities |

|

Fund |

Betashares Wealth Builder Australia 200 Geared (30-40% LVR) Complex ETF |

Betashares Wealth Builder Diversified All Growth Geared (30-40% LVR) Complex ETF |

|

ASX Code |

G200 |

GHHF |

|

Underlying portfolio |

200 largest ASX-listed companies |

Diversified basket of Australian and global developed and emerging markets equities |

|

Management fee and costs |

0.35% p.a. of Gross Asset Value |

0.35% p.a. of Gross Asset Value |

With one easy trade on the ASX, investors can unlock the power of gearing with exposure to a portfolio of Australian and global stocks without the hassle of complicated loan applications.

The gearing ratio (being the total amount borrowed expressed as a percentage of the total assets of each Fund) will generally vary between 30% and 40% on a given day. This means that each Fund’s geared exposure is anticipated to vary between ~143% and ~167% of the Fund’s Net Asset Value on a given day. Each Fund’s portfolio exposure is actively monitored and adjusted to stay within this range.

Each Fund’s returns will not necessarily be in this range over periods longer than a day, primarily due to the effects of rebalancing to maintain the Fund’s daily target geared exposure range and the compounding of investment returns over time, and the impact of fees and costs.

Each Fund’s returns over periods longer than one day may differ in amount and possibly direction from the daily target geared return range. This effect on returns over time can be expected to be more pronounced the more volatile the relevant sharemarket or portfolio and the longer an investor’s holding period.

Due to the effects of rebalancing and compounding of investment returns over time, investors should not expect each Fund’s Net Asset Value to be at a particular level for a given value of the relevant sharemarket or portfolio at any point in time.

Investors should monitor their investment regularly to ensure it continues to meet their investment objectives.

Gearing magnifies gains and losses and may not be a suitable strategy for all investors. Investors in geared strategies should be willing to accept higher levels of investment volatility and potentially large moves (both up and down) in the value of their investment. Geared investments involve significantly higher risk than non-geared investments. An investment in the Fund is high risk in nature.

There are risks associated with an investment in the Betashares Wealth Builder ETFs, including market risk, underlying ETF risk, gearing risk, rebalancing and compounding risk and lender risk, as well as (where the relevant Fund provides global equities exposure) asset allocation risk and currency risk. Investment value can go up and down. An investment in each Fund should only be made after considering the investor’s particular circumstances, including their tolerance for risk. For more information on risks and other features of each Fund, please see the applicable Product Disclosure Statement and Target Market Determination, both available on this website.