Ankita Rai, InvestmentMarkets

21 June, 2024

Despite the ongoing economic slowdown and persistently high office vacancy rates, there are promising signs that the commercial property market is gearing up for a rebound.

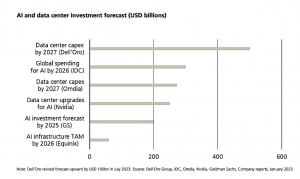

The rapid expansion of the data centre sector, fuelled by the exponential growth of generative AI and cloud computing, is driving a noticeable surge in commercial real estate activity, both locally and globally. Major players in the industry, such as Equinix, Digital Realty, Blackstone, and Goodman Group, are ramping up their investments in this fast-growing sector, reflecting their widespread confidence in its potential.

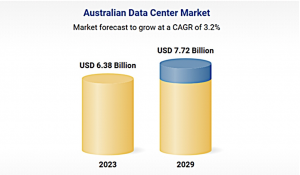

The global mega data centre market is projected to reach US$39.7 billion by 2032, growing at a CAGR of 4.8%. The Australian data centre market is also aligned with the same global trend and is expected to reach a value of $7.72 billion by 2029, growing at a CAGR of 3.2%.

Source: Research & Markets

Global and local demand on the rise

AI is creating unprecedented demand for high-quality data centre capacity. In the first five months of 2024 alone, a staggering $22 billion was globally invested in data centres, compared to $36 billion in 2023.

While the US maintains its lead, accounting for a substantial 62% of the total global investments last year, the APAC region has also made its mark with its recent exponential growth. The region’s data centre deals reached a record high of $3.45 billion last year. This global trend has been further reinforced by property giants and global hyper-scalers such as Microsoft and Amazon, who are investing significantly in the space.

The Australian data centre opportunity can be gauged by the growth of property giant Goodman Group, a leading local player that provides essential infrastructure such as warehouses and data centres. Data centres now represent 40% of its $13 billion worth of projects underway worldwide. Its data focus is working. Goodman Group increased in its earnings guidance for the second time this financial year.

This surge in demand is also evident in the performance of domestic data centre stocks. Goodman Group shares have surged by 76% over the past year, NextDC’s shares have risen by 42%, and Macquarie Technology Group shares have increased by 37%. These strong returns are arguably justified. Australia is now among the top five data centre hubs with Goodman, AirTrunk, Equinix, NEXTDC, DCI Data Centres, and Macquarie Data Centres among some of the key investors.

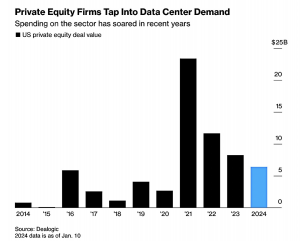

Private equity firms are also cashing in on the picks-and-shovels of the AI gold rush. From Blackstone to Brookfield Infrastructure Partners to KKR, private equity firms bought data centres in near-record numbers last year, defying a broader deal-making slowdown. More than $US43 billion in US data centre deals closed between 2021–2023, according to Dealogic.

The hype is real

The excitement around data centres is nothing new for digital infrastructure investors. For instance, three years ago, there was a lot of hype about cryptocurrency driving a surge in data centre demand due growing demand from crypto miners. However, many crypto mining projects failed due to market fluctuations. Similarly, there was anticipation that the metaverse would boost the adoption of data centres and the Internet of Things, but widespread implementation fell short of expectations.

What’s different this time is that AI has the endorsement of large and credible companies, such as Microsoft and Amazon, which also happen to be among the largest data centre customers.

So, as the generative AI market is set to grow exponentially with revenues forecast to increase nearly 20-fold to US$1.3 trillion by 2032, demand for additional data centre capacity will also rise significantly.

The data centre investment opportunity

Data centres are emerging as a lucrative sector for investors amid the slowdown in the global economy. In fact, record low vacancies, high demand, and rising rental rates have made it a dominant real estate investment theme this past year.

One way to tap into the potential tailwinds of the data centre industry is by buying stocks of key cloud providers such as Microsoft, Amazon, and Alphabet. However, these are diversified plays. For more focused exposure, stocks like NextDC, Macquarie Technology, and Goodman Group, which heavily invest in data centres, could be better options.

In addition, data centre real estate investment trusts (REITs) that typically rent space to multiple customers, including hyper-scalers, can offer attractive returns with the potential for dividend growth. While the real estate sector as a whole has been one of the worst performing sectors of late, and REITs are highly sensitive to interest rates, data centre REITs differ.

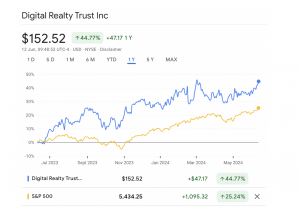

As a result, Data centre landlords like Digital Realty Trust and Equinix, Inc. have defied the overall REIT trend, strongly outperforming both the REIT sector and the S&P 500 over the past year.

Source: Google Finance

Another data centre REIT, Equinix, delivered an impressive result for Q1’24 with 6% revenue growth and is guiding for profitable growth in FY2024, benefiting from ongoing cloud migration and a rapidly evolving AI landscape.

Investing in tomorrow’s infrastructure

The appeal of gaining exposure to the massive AI boom while enjoying the perks of real estate makes data centres an attractive investment opportunity.

As the global economy increasingly shifts online, big tech’s demand for substantial infrastructure to support the rise in its computing processes is imminent. With limited supply and increasing demand for data centres, established owners like Digital Realty Trust have a strategic advantage as they already have the capacity in place. This is crucial given the lengthy processes involved in acquiring land, undertaking construction, and managing huge power requirements.

Investors may be well advised to ensure they have exposure to the data centre theme as more property investors increase allocations to this fast-growing sector.

What it means for investors

- Data centres are emerging as a lucrative sector amid the slowdown in the global economy. Record low vacancies, high demand, and rising rental rates have made it a dominant real estate investment theme this past year.

- While the real estate sector has faced challenges, data centre REITs such as Digital Realty Trust and Equinix, Inc. have outperformed the REIT and S&P 500, demonstrating lower sensitivity to interest rates.

- The excitement around data centres isn’t new; past trends like cryptocurrency and the metaverse fell short. However, AI-driven growth now has strong backing from major companies like Microsoft and Amazon, which are also significant data centre customers.

Originally published on InvestmentMarkets