Ankita Rai, InvestmentMarkets

8 May, 2024

With the significant gains witnessed in AI stocks such as Nvidia, Microsoft, Meta, and Super Micro Computers over the past year, many investors are now pondering whether it’s too late to jump onto the AI bandwagon—and rightly so.

The advent of ChatGPT and its rapid adoption radically changed the investment landscape. The gains of AI-related stocks, especially mega-caps such as Nvidia, Meta Platforms, Microsoft, Alphabet, and Amazon, have contributed to a large chunk of the broader global market rally in recent months.

The AI tailwinds have continued into 2024, with artificial intelligence driving global stock markets to record their best March-quarter performance. The Nasdaq is up 30% over the past year, primarily thanks to excitement over AI. Similarly, the MSCI AC World Information Technology Index, which tracks tech stocks in developed and developing markets, is up more than 20% from a year ago.

But don’t fret if you missed the boat over the past year. Even with all this excitement, we’re just scratching the surface of AI’s long-term potential. According to Grand View Research, the global AI market could hit US$1,811.75 billion by 2030, growing at a whopping 37.3%. With the industry nearing US$200 billion last year, there’s still plenty of time for investors to benefit from the AI investment theme.

The Magnificent Five are the essential AI plays

Nvidia, Microsoft, Meta, Amazon, and Alphabet are the obvious names when considering exposure to AI. These companies are not only investing heavily in the sector but also possess the brand power and resources to thrive in this dynamic landscape.

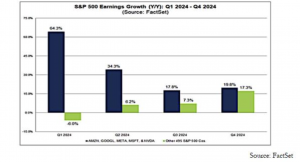

The Mag five are projected to be the top contributors to earnings growth for the S&P 500 in 2024, according to Factset. Together, they’re expected to achieve a 64.3% increase in the March quarter alone. Excluding them, the S&P earnings would decline by 6% in the period. Analysts expect this cohort to account for a significant portion of the S&P 500’s earnings growth throughout this year as shown in the chart below.

Nvidia continues to be the best AI bet

Among the big techs, the AI bellwether Nvidia continues to dominate. The stock is up 77% year-to-date, far outpacing the Nasdaq’s 6.1% increase. Most Wall Street analysts expect the stock to soar further.

Nvidia represents a compelling investment. Despite its remarkable surge since 2023, analysts view it as reasonably priced, with Citi noting that Nvidia’s AI server processor chips sales could grow at a 50% compounded annual rate over the next five years.

Nvidia’s ability to adapt and diversify its product offerings has helped it grow fast. Revenue from various segments, including AI chips, data centers, and gaming, has surged. In Q4 2024, revenue soared by 265% YoY to $22.1 billion, with expectations of the company generating $24 billion of revenue in Q1 2025.

Beyond Nvidia, Microsoft, Alphabet, Meta, and Amazon continue to be strong players with an increased focus on AI investments. In the March quarter results released last month, Microsoft, Meta, and Alphabet all surpassed expectations in terms of revenue growth, fuelled by their significant AI investments.

But among them, Microsoft continues to be a clear leader due to its deal with OpenAI and the significant growth seen in the cloud computing business. It is not only gaining ground on cloud-computing leader Amazon, but has also outpaced Google with tools like Copilot.

For investors eyeing stocks in the big tech cohort, considering companies like Microsoft with robust AI initiatives presents a promising prospect. Microsoft’s strong presence in the AI, cloud, and software markets offers compelling long-term growth opportunities.

The bigger picture is also evolving

As more businesses integrate AI into their operations, opportunities are opening up across sectors. From infrastructure to software and applications, a diverse range of companies are acting as both enablers and adopters of AI, offering investors an exciting investment opportunity across the AI value chain.

Consequently, investors should consider not only well-known AI leaders like Nvidia and Microsoft, but also companies like TSMC and Qualcomm, which provide essential materials and chips for AI development, or Super Micro Computers which is a supplier of servers essential for generative AI apps.

Super Micro Computers has seen its shares rise by 200% so far this year, while TSMC and Qualcomm have experienced around a 33% and 19% increase year-to-date, respectively.

On the software front, Palantir is emerging as a serious rival to big tech. Given a 190% surge in its share price over the last year, it is seen as the next big opportunity in the enterprise software market.

Building a robust portfolio with ETFs

While mega-cap companies offer a solid starting point due to their heavy investments in AI, identifying individual stocks with significant growth potential beyond this cohort can be challenging. One strategy to overcome this challenge is investing in ETFs.

Using ETFs can help mitigate the risk of single stock concentration by capturing the broader AI theme through a basket of stocks with varying levels of exposure. This approach can provide exposure to the entire AI value chain, from semiconductors to developers and hardware providers and infrastructure.

ETFs like Robo Global Artificial Intelligence ETF and Global X Artificial Intelligence & Technology ETF are among the top-performing ETFs in this space with more than 35% returns over the past year.

Getting ready to dive in

Investing in the AI theme has been a focused affair thus far, with the largest tech stocks yielding robust returns. However, as the market expands, adopting a broader and more balanced approach becomes imperative.

Investors aiming for AI exposure should ensure their portfolios encompass companies spanning the AI value chain. While the current phase favours AI tools and enablers, investors should also keep an eye on the beneficiaries poised to emerge next.

There is still a long runway ahead and despite the market’s meteoric rise over the last year, investors still have much to gain from AI.

What it means for investors

- Despite recent gains, the AI market is still in its early stages, with projections indicating substantial growth potential. Investors can capitalise on this trend by considering investments in established AI leaders and emerging players alike.

- Nvidia, Microsoft, Meta, Amazon, and Alphabet are leading the AI charge. These companies not only invest heavily in AI but also possess the brand power and resources to thrive. They are projected to drive significant earnings growth, making them attractive options for investors.

- While mega-cap companies serve as a solid starting point for AI investment, diversifying through ETFs can help mitigate risks and provide exposure to various segments of the AI value chain, from semiconductors to software development.

Originally published on InvestmentMarkets