Brought to you in collaboration with Sharesight – 4 September, 2024

Exchange-traded funds (ETFs) are an increasingly popular type of investment fund that can be bought and sold directly on stock exchanges. Among Sharesight users, the share of ETFs within investor portfolios has grown steadily over the last decade from <1% to almost 10% as investors increasingly switch from managed funds (managed trusts) to ETFs. Like all investments, it’s critical to track the performance of ETFs in your portfolio. In this article we’ll cover:

ETF history

There is some contention over which ETF commands the title as “the first ETF”. However, the concept of using a listed investment trust structure as a vehicle to invest in a broad range of underlying stocks gained traction in the early 1990s, with the launch of the S&P 500 Trust ETF “SPDR” (NYSE: SPY) on January 22 of 1993.

Initially, ETFs followed in the footsteps of the SPDR ETF and allowed investors to gain exposure to a fund that sought to replicate (minus fees) the performance of a ‘passive’ market index like the S&P 500. Over time fund managers added “smart-beta” (seeking to replicate an ‘alternative’ index) and “active” (actively managed by a fund manager with a strategy aiming to beat the market) ETFs to their offerings, further blurring the lines between managed funds and their exchange-traded fund cousins.

Read our guide on what to look for when buying ETFs if you’re considering investing in exchange traded funds.

Tracking ETF performance

ETFs have an open ended structure, which means that when investors seek to purchase additional units of the fund, the fund manager (or issuer) can issue additional units to the exchange. This means that unlike listed investment companies that can trade significantly above or below their Net Asset Value, ETFs trade at a unit price close to the value of the underlying assets each unit holds. And unlike managed funds, which can have opaque price discovery, tracking the performance of ETFs is much like any other stock, because ETFs are listed (and traded) on stock exchanges.

ETF tax considerations

Tracking the performance of your ETF investments is only one part of the puzzle; managing the tax implications is the other. ETFs are a unitised trust structure that hold a number of underlying assets that each have their own tax implications on distributions earned by the ETF. The tax implications will vary by region; for example in the USA distributions earned by the ETF are typically treated as ‘ordinary dividends’ and taxed accordingly, whereas in Australia most ETFs use the Attribution Managed Investment Trust (AMIT) structure and are a tax nightmare. ETFs also create complexity for UK investors, as depending whether the ETF has reporting status or not, or whether it was purchased through an ISA or SIPP, this can have significant implications on how it is taxed.

Here are all the ways Sharesight makes ETF tax calculations easy.

How to track ETFs in Sharesight

It’s easy to track the price and performance of your ETF investments, with Sharesight’s support for over 60 global stock exchanges. Here’s how to add an ETF to your Sharesight portfolio(s):

- Sign up for a FREE Sharesight account.

- You can add an ETF to your portfolio(s) by manually adding a trade and searching for the ETF’s name in the relevant market (eg. NYSE: SPY). You can also use the Sharesight file importer to bulk import trades to your portfolio.

- Sharesight converts the prices and valuations of your holdings from their listed market to your portfolio’s base currency. It also automatically calculates any currency fluctuations on a daily basis and backfills past dividends and distributions (and continues to add new ones as they are announced).

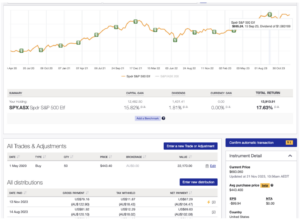

ETF benchmarking with Sharesight

Exchange traded funds make for excellent ‘index tracking’ (such as the S&P 500) benchmarks because they take into account all the inner workings of a real portfolio, including fees, dividends and any franking credits that may apply. Sharesight allows investors to benchmark against ETFs as well as any managed fund, trust or stock tracked by Sharesight.

An example of an ETF-based portfolio benchmarked against the S&P 500.

To select an ETF as a benchmark, simply click “Add a Benchmark” on the portfolio’s Overview page. You can either select from a common ETF benchmark or type in the market code and select the ETF of your choice.

Track your ETFs (and the rest of your portfolio) with Sharesight

Join thousands of global investors using Sharesight to track their ETFs along with the rest of their investments. If you don’t already have a Sharesight account, click here to get started.