Nicole Kidd, Managing Director, Schroders RF

Part Two: The interplay of rates, inflation and real estate.

In the previous instalment we discussed interest rates, inflation and how this impacted Commercial Real Estate (CRE). In Part Two, we will look at how Commercial Real Estate loans are priced and how to think about relative value in the context of a rate easing cycle.

The February RBA meeting delivered a much-anticipated rate cut of 25 basis points, but the RBA commentary signalled that the cut should be viewed as a one-off at this stage given continued surprising strength in the labour market and potential upside risks from higher government spending and international impacts from, among other things, possible US tariffs.

The rate cut was welcomed by all with mortgages, less so by those with money in the bank – and is very useful for this article insofar as it allows us to demonstrate loan pricing before and after the rate cut, and to explore how investors might assess fixed rate debt investments in the context of falling cash rates.

The price of a loan is made up of two parts – the base rate (RBA cash rate or a similar benchmark) and the credit margin. The credit margin should be adequate compensation for the credit risk being assumed when investing in the loan. For example, all other things being equal, a loan with a higher loan-to-value ratio (LVR) carries more risk than a loan at a lower LVR and typically attracts a higher credit margin.

The credit margin itself can be broken down into numerous components:-

- Illiquidity margin – the price for the fact the loan cannot be easily traded on a public market

- Complexity margin – the price compensating for how complex or highly structured a loan is. The complexity is influenced by factors such as the loan’s position in the capital structure (for instance, in real estate loans, whether a first registered mortgage is held, or is the loan sitting lower in the capital structure with a second mortgage or a mezzanine tranche ), the loan-to-value ratio (LVR), where the security is located and the assessment taken on refinancing risk

- Market risk – not an obvious one for private credit however market risk might include an allowance for competitive forces where a transaction may be highly sought after by multiple lenders and so pricing is highly competitive.

Regardless of the movements in the RBA base rate / cash rate, preserving the credit margin can help maintain the attractiveness of the asset class during an interest rate easing cycle. Loans fixed earlier in the easing cycle may also benefit from improved effective margins as the cycle progresses.

Worked Example: Impact of Rate Cuts

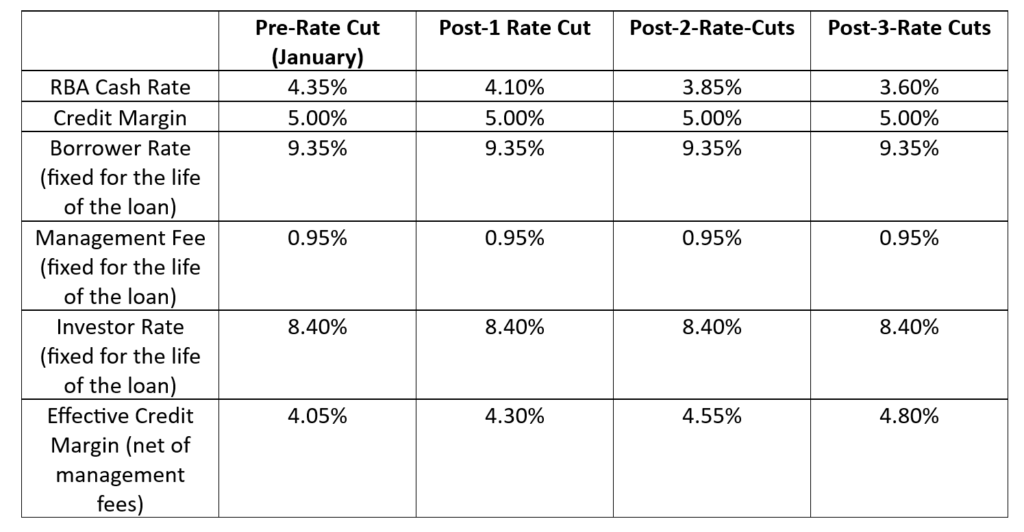

In this example, we will work through loan pricing before and after the recent RBA rate cut, and then we will also model two hypothetical 25 basis point cuts. For our worked example, the key variables considered are the base rate (the RBA cash rate at each given time), the credit margin and the management fee.

Private credit margins do vary based on the factors outlined above, but in our experience, they typically range from 4.75% – 6.50%. For this example, we have assumed a 5.00% credit margin and a 0.95% management fee.

As you can see, fixed rate loans entered into earlier in a rate easing cycle could result in higher returns relative to the benchmark rate, depending on loan performance. These loans may also outperform asset classes which dynamically reprice during periods of rate adjustment, such as variable rate loans, bonds, at-call bank accounts and so on.

Long-term bond yields have been declining since mid-2024, with rate cuts already priced into that market. While CRE Private Debt is illiquid, typically has a shorter duration, and credit-related risks, it may offer a potential strategic option for enhancing yield within a diversified portfolio alongside traditional investment strategies.

Note: The above should not be construed as financial advice. Retail investors should consult a financial advisor before considering investing into products such as Schroders RF Select Credit Fund. Schroders RF Select Credit Fund is considered a medium to high-risk product. The Product Disclosure Statement and Target Market Determination can be obtained from www.schrodersrf.com