By Mark Gardner, CEO, Head of Equities, MPC Markets

22 November 2023

In the wake of the Federal Reserve’s recent series of interest rate hikes, the financial landscape is bracing for significant shifts, particularly in the equities market. These increases, aimed at cooling an overheating economy and controlling inflation, are anticipated to steer the stock market into a phase of stagnation or decline, deviating from its usual growth trajectory. Historically, rising interest rates have often dampened market enthusiasm, and the current economic conditions suggest a similar outcome. Investors and market analysts are now faced with the challenge of navigating this new reality where traditional growth expectations may no longer hold. The critical task at hand is deciphering how to successfully invest in a market that is likely to be range-bound or on a downward trend.

Key to this approach is understanding which sectors are most vulnerable to interest rate hikes and which may demonstrate resilience. Adapting investment strategies to counter potential market downturns and identifying opportunities in a subdued market environment are essential. This article aims to dissect the expected directional shift in the equities market due to rising interest rates and offer strategic insights for investors to manage risks and seek viable opportunities in a landscape where traditional growth paths may not hold true.

The Dynamics of Interest Rates and Stock Market Performance

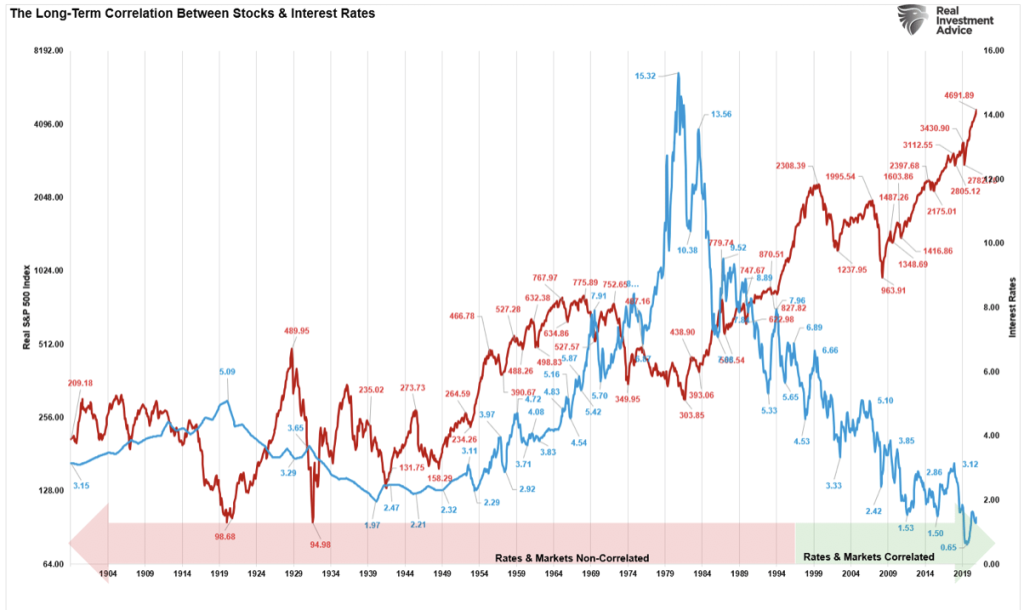

Over the past century, the interplay between interest rates and the stock market has demonstrated a complex pattern, often tilting towards a negative correlation. Historical data over this period, if represented on a chart, would reveal instances where rising interest rates coincided with a stagnating or declining stock market. Generally, higher interest rates lead to increased borrowing costs, impacting consumer spending and business investments—two pivotal pillars of stock market growth. Consequently, as interest rates climb, the stock market often tends to either move sideways or experience a downturn.

While there have been periods where the stock market has shown resilience or even growth following a rate hike, these instances are typically short-lived. Initially, rate increases might reflect a strong economy, which can temporarily buoy the stock market. However, as higher rates persist, their impact becomes more pronounced, leading to reduced economic activity and investment, thereby dampening stock market performance.

This historical trend suggests that in the current environment of rising rates, investors may need to brace for a market that is less likely to witness the robust growth seen in lower interest rate periods. Adapting to this environment requires a strategic shift in investment approaches, focusing on sectors less sensitive to interest rate changes and prioritizing stability and risk management in investment decisions. Understanding the nuanced reactions of the stock market to interest rate hikes, particularly in the context of the current economic landscape, is crucial for investors aiming to navigate these challenging conditions successfully.

The Evolving Impact of Federal Reserve Decisions on Stock Markets

The influence of the Federal Reserve’s decisions on the stock market has become increasingly pronounced, reflecting an evolution in market sensitivity to interest rate changes. Over the years, especially since the early 2000s, the Fed’s role in financial market stability has grown, markedly changing the way stock markets respond to monetary policy shifts. The introduction of policies like Quantitative Easing post-2008 is a prime example of how the Fed’s actions have directly impacted market movements.

This evolving dynamic is particularly visible in the stock market’s heightened sensitivity to interest rate changes. Where once the market may have shown a degree of resilience or indifference to rate hikes, it now reacts more acutely. This change can be attributed to the increased reliance of investors on the Fed’s policy directions as indicators of economic health and market prospects. As such, each decision or announcement by the Fed is scrutinized for its potential impact on market trends.

In today’s investment landscape, the Fed’s ongoing adjustments, particularly the recent trend towards increasing rates, are met with immediate and significant reactions in the stock market. This heightened sensitivity underscores the importance of understanding and anticipating Federal Reserve policies. For investors, this means a more vigilant and responsive approach to investing, factoring in the potential effects of monetary policy changes on market behaviour.

Sector-Specific Impacts of Rising Interest Rates

Historically, certain industries are more vulnerable to these changes, while others might find unexpected opportunities.

Vulnerable Sectors:

– Technology: High-growth industries like technology are particularly sensitive to rising interest rates. This is because their valuations often hinge on future earnings, which get discounted more heavily as interest rates increase. As borrowing costs rise, tech companies, known for their reliance on external financing for growth and innovation, may face challenges in sustaining their growth trajectories.

– Consumer Discretionary, Industrials, and Materials: These sectors often underperform in the aftermath of rate hikes. Higher interest rates can dampen consumer spending, affecting companies in the consumer discretionary sector. Similarly, industrials and materials sectors, reliant on economic expansion, might see reduced profits as borrowing becomes more expensive and economic growth potentially slows.

– Resilient or Beneficial Sectors:

– Financials: Banks and financial institutions typically benefit from a rising rate environment. Higher rates can lead to wider net interest margins, boosting the profits of banks. As long-term bond yields rise, financial stocks, particularly banks, tend to perform better.

– Energy: Energy sector stocks may also see positive effects. Often, rising interest rates coincide with stronger economic activity, which can increase demand for energy.

– Utilities and Healthcare: These sectors are traditionally seen as defensive. Companies in utilities and healthcare often provide essential services, making their revenues less tied to economic cycles. In times of economic uncertainty or rising rates, these sectors can offer stability to investors.

As the Federal Reserve continues to adjust rates in response to economic conditions, investors need to be mindful of these sector-specific reactions. Diversifying investments and being strategic about sector exposure can help navigate the complexities of a high-interest rate environment.

Strategies for Investors

Adapting investment strategies is crucial in this environment. One key approach is diversification, which involves spreading investments across various asset classes and sectors. Diversification helps mitigate the risk associated with any single investment or sector, especially important in a high-interest rate climate where certain sectors may underperform.

Active portfolio management is also essential. This means regularly reviewing and adjusting investments to respond to changing economic indicators and market trends. For instance, shifting focus towards sectors likely to benefit from higher interest rates, like financials, or stable sectors such as utilities and healthcare, can be a strategic move.

In later stages of an interest rate hike cycle, bond investments often become increasingly attractive. As rates climb, yields on bonds rise, presenting opportunities for higher returns. These enhanced yields can sometimes surpass those offered by high dividend stocks, often with lower risk. This shift can make bonds an appealing option for those seeking steady income or a more conservative investment approach. As the cycle progresses and yields increase, investors may find value in reassessing their portfolios to capitalize on these emerging bond opportunities, balancing their investment mix to optimize returns while managing risk effectively.