Simon Turner, Head of Content, InvestmentMarkets

30 April, 2024

Remember when the 60/40 portfolio was regarded as a rock solid approach to portfolio construction?

How times have changed.

2022 was the year when the 60/40 portfolio raised eyebrows for all the wrong reasons. Rather than benefitting from the defensive attributes of the 40% of the portfolio invested in bonds, that portion of the portfolio underperformed alongside traditionally more volatile equities. It resulted in a disastrous year’s performance, the reasons for which continue to raise valid questions about the appropriateness of the 60/40 portfolio for the coming years.

The rationale for the 60/40 portfolio

Traditionally, the 60/40 portfolio was a portfolio 60% invested in equities and 40% in bonds. It was generally accepted that younger investors may tilt the default 60/40 portfolio more to equities, and older investors may have a higher exposure to bonds.

The rationale behind the 60/40 approach to portfolio construction was that equities almost always outperform over the long term, but they can be very volatile. In contrast, bonds have tended to be much less volatile and have generally been negatively correlated with equity markets.

The resulting 60/40 portfolio was often regarded as well-positioned to weather the ups and downs of stock markets whilst still generating long-term solid returns.

The problem with the 60/40 portfolio

The problem with the 60/40 portfolio is that it sometimes doesn’t do what it says on the tin.

When it doesn’t work it tends to generate strongly negative returns:

2022 was the most recent year that really raised questions about how appropriate the 60/40 portfolio is. The strategy bounced back in 2023, but it was the size of and reasons for the negative performance in 2022 which wrong-footed so many investors.

The issue was that at the very moment equities underperformed and 60/40 investors needed their bond portfolios to outperform, bonds performed more like equities. They lost their defensive characteristics when they were needed.

The unwelcome return of inflation

So why did the 60/40 portfolio disappoint so badly in 2022?

In a word, inflation.

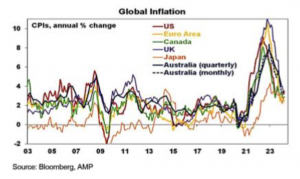

60/40 portfolios tend to underperform, particularly in real terms, during periods of higher inflation—like recently:

The energy and commodity sectors are front and centre in this dynamic. When raw material prices are low, as they have been in recent years, investment in new supply decreases and supply falls, which leads to higher commodity prices, higher inflation, and ultimately higher interest rates.

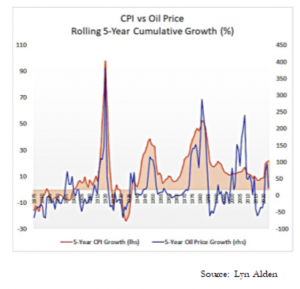

On that note, the correlation between inflation and oil prices is important to bear in mind:

Higher interest rates are bad news for bonds which explains why bonds lose their defensive attributes during periods of higher inflation.

Why a more nuanced approach may be more appropriate

If inflation is here to stay, along with flat or higher interest rates, then bonds are unlikely to offer the same defensive attributes which warranted their 40% portion of the 60/40 portfolio.

This is not to suggest bonds won’t generate solid returns in the coming years, but the key issue from a portfolio construction perspective is that bonds are unlikely to serve as the portfolio ballast they were in the past if inflation remains higher for longer.

If that is indeed the case, then bonds should arguably be considered more tactically. A smaller, more flexible bond weighting may well be appropriate.

Alternative portfolio construction strategies to consider

So the 60/40 portfolio may have had its day, at least for now.

The good news is there are many alternative portfolio construction theories to consider.

Most of them recommend including a commodity or gold component in addition to equities and bonds—for good reason.

History teaches us that the asset classes which tend to outperform during periods of equity market weakness during inflationary periods are gold, silver, energy, copper and other commodities. Owning these types of assets which actually benefit from the inflation they are causing may well offer the diversification benefits 60/40 investors of the past aimed for.

For example, Meb Faber and Eric Richardson’s The Ivy Portfolio recommends investing 20% in domestic equities, 20% in international equities, 20% in bonds, 20% in commodities, and 20% in REITs. They also

recommend only remaining invested in each asset class if there’s a structural uptrend at play. If that’s not the case, they recommend moving that 20% portion into cash and waiting. Food for thought.

Be realistic about the outlook in your portfolio construction

The ideal portfolio for you will reflect your risk and return objectives, your age, your time horizon, and a host of other financial factors. Whether you’re deciding on how to construct your portfolio by yourself or with the help of a financial adviser, it’s important to consider your personal circumstances in depth.

It’s also important to be realistic about what to expect from financial markets in the coming years. At this juncture, there are compelling reasons to look beyond the 60/40 portfolio to a more nuanced approach which factors in the possibility that inflation is here to stay, along with higher-for-longer interest rates. The implications for future asset class performance are simply too significant to ignore.

In particular, replacing a portion of the 40% invested in bonds in a typical 60/40 portfolio with energy, gold, silver, and other commodities could well be a prudent move over the coming years.

Originally published on InvestmentMarkets