Simon Turner, Head of Content, InvestmentMarkets

10 July, 2024

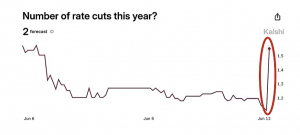

It’s been a wild ride in recent months for Fed rate expectations. Back in January this year, a buoyant US market expected seven Fed rate cuts by the end of 2024. By March, the market had sobered up a little and expectations had fallen to three rate cuts for the year. But now markets are only expecting one Fed rate cut in 2024. Interestingly, despite pricing out a full six rate cuts since the start of the year, the S&P 500 is up 15% year to date.

At this point, it’s worth asking what happens if the Fed does cut rates once (or more) given the market has already wrong-footed so many investors this year.

Why a Fed shift would matter Down Under

It won’t have escaped most Australian investors notice that the US market, particularly the Magnificent Seven, has significantly outperformed the ASX for many years now.

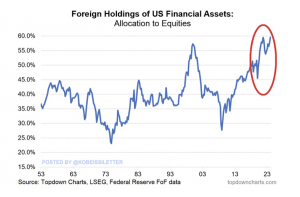

In response, a growing number of Australian investors have increased their exposure to the outperforming US market over the past year and a half. It’s a common story in most non-US markets with foreign holdings of US financial assets currently at around all-time highs.

Beyond being directly exposed to the US market, as many Australian investors are, the other reason the Fed’s rate decisions matter to local investors is that developed world central bankers tend to operate in tune with one another due to the global nature of inflationary forces.

So if the Fed cuts rates, there’s likely to be more pressure on the RBA and other developed world bankers to follow suit.

The Fed’s latest guidance

At its June meeting, the Fed kept its benchmark interest rate in the 5.25-5.50% range, and guided for one rate 25 basis point cut by the end of the year. Fed Chair Jerome Powell mentioned that the first rate cut will be ‘consequential’ because it is likely to reset market expectations.

He also said he’s awaiting more data to confirm that inflation is moderating toward the Fed’s 2% PCE (personal consumption expenditure) inflation target amidst an uncertain economic outlook.

Compelling reasons to cut

Market expectations of the number of Fed rate cuts this year increased in response to the Fed’s June meeting commentary, but remain close to the Fed’s guidance of one cut.

It hasn’t escaped investors’ notice that the Fed has compelling reasons to cut rates in the short term. Namely:

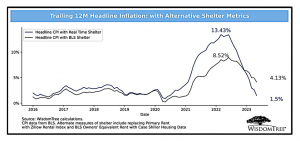

- Inflation has been falling and is approaching the Fed’s 2% target for PCE inflation (currently 2.7%).

Given the rental estimate used to calculate both CPI and PCE tends to trail real-time measures of housing costs, the Fed will be aware that the headline data is probably overstating inflation at this juncture. Using a more accurate real-time measure of shelter costs, headline CPI is arguably running closer to 1.5% which is below the Fed’s target.

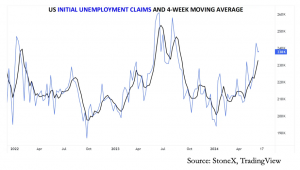

- US jobless claims have been rising in recent months reflecting a high immigration rate and a weakening economy. Given the health of the jobs market is half of the Fed’s mandate, this momentum shift is an important one for future rate decisions.

- US household real income growth expectations have plummeted in recent weeks and are currently at a 10-year low.

https://x.com/KobeissiLetter/status/1803817579821093213

This data-point could well be the economic canary in the coal mine given the recent decline is the steepest in over sixty years—and even steeper than during the Global Financial Crisis. The message to the Fed is unavoidable: US households are feeling the pain of inflation and higher interest rates.

- The US election is only four and a half months away.

Given the Fed’s need to appear apolitical, the upcoming election on November 5th means its window to cut rates while remaining apolitical is relatively small. In fact, the Fed’s July meeting (July 30th/31st) may present its last opportunity to cut rates without appearing political.

In the words of Cullen Roche at Discipline Funds: ‘Cutting in July also sets the precedent that they’re starting and so if they needed to cut again right before the election it wouldn’t look politically motivated. In other words, a move in July hedges lots of downside bets without risking a second runaway wave of inflation.’

The popular narrative about Fed rate cuts

If the Fed does cut rates as expected, there’s the indisputable bullish argument that investors are currently buying into: a cut in official interest rates feeds through into higher discounted cash flows. That’s the cup half-full vision that investors are getting excited about—and that’s inspiring the consensual expectation that equity markets will rally on the news of a Fed rate cut.

This view is supported by US Government spending of around 6% of GDP each year, and the upcoming US election which tends to be bullish for stocks.

So we should be preparing for a continuation of the US-powered global equities party, right? Not so fast.

The inconvenient truth about Fed rate cuts

Of course, it matters a great deal why the Fed (or any central bank) is cutting rates, rather than the rate cut in isolation.

If the Fed is cutting rates because the US economy is decelerating, then there’s a risk that they are moving too late to avert a recession. There have been many precedents of this being the case in the past.

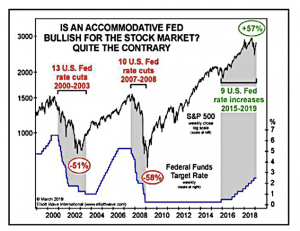

Hence, rate cuts have historically been negative for the S&P 500. In fact, the last two rate cutting cycles led to market declines of over 50%.

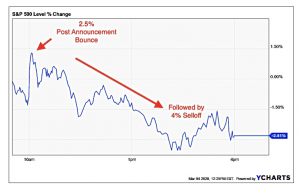

Interestingly, markets have tended to initially respond positively to Fed rate cute announcements, but that initial enthusiasm has often eroded into fearful selling for the above-mentioned reason—as was the case in March 2020.

So the inconvenient truth is that the US equity market has a track record of reacting negatively to Fed rate cut announcements due to the economic concerns driving the decision. If history were to repeat, the knock-on effects are likely to be felt across global equity markets, including in Australia.

Tread carefully

With the Fed’s pre-election window for rate cuts running out of time, a July cut could well be on the cards. Whilst that would probably trigger market expectations of more rate cuts, which is bullish for valuations, the reasons for the cut may ultimately prove to be bearish for markets.

Based on the lessons of the past, investors best prepare themselves for volatility before and after the upcoming Fed meetings, particularly the one at the end of July.

Originally published on InvestmentMarkets