Simon Turner, Head of Content, InvestmentMarkets

14 May, 2024

Berkshire Hathaway’s cash pile reached a new all-time high of $US189 billion by the end of Q1 and is expected to continue rising from here. It’s unusual to see a global leader sitting on cash worth 22% of its market cap, and it’s particularly noteworthy when one of the greatest investors in history is at the helm.

For an investor of Warren Buffet’s genius, one thing is for sure: sitting on a such a massive cash pile is a conscious and informed move which the rest of us can learn lessons from.

Berkshire’s cash mountain

Berkshire Hathaway’s cash pile has been trending upwards for decades but the recent rapid growth is unusual even by the company’s defensive standards. As shown below, the last time the company grew its cash so aggressively was back in 2003.

As you can imagine, Buffet is often asked about the company’s growing cash reserves. When he was recently asked about it, he said, ‘I don’t mind at all, given current conditions, building our cash position.’

Translation: valuations are stretched

There are many ways to ascertain whether global equities are cheap or expensive, so making a blanket statement about current valuations is often pointless … except if you’re Warren Buffet and a master of value investing.

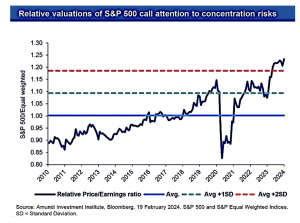

From a pure valuation perspective, there’s an argument to be made that equities are expensive at present. As shown below, the all-important S&P 500 index is trading at over two standard deviations above its equal weighted valuation mean.

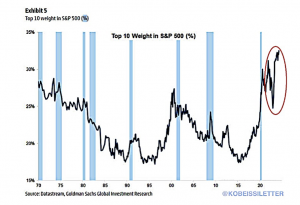

However, context has to be added to this picture. As shown below, the top ten stocks in the S&P 500 now represent 34% of the index’s entire market cap and have increased by more than 10% in just two years. That’s an even higher portion than at the peak of the dot-com bubble so the top ten stocks are distorting the average valuation data considerably.

What we can all learn from Buffet’s cash pile

Regardless of your opinion on current market valuations, there are a few key takeaways for investors:

- When you can’t find a better idea, cash may be the best investment – With money market funds paying upwards of 5% p.a. at present, it’s been many years since holding cash was as lucrative as this. Higher yields are surely making Buffet more comfortable with sitting on such a large cash pile. So the lesson here is: if you can’t find a compelling use for your cash, now may well be a good time to place it in a high yielding money market fund or term deposit.

- Value may be more challenging to find – Buffet’s track record suggests there may be credence to this viewpoint. At the same time, it’s a lot easier to invest as a small individual investor than it is to invest billions of dollars in each investment as Berkshire Hathaway does. The useful lesson for individual investors may be that it’s a good time to cast your investment net further afield than the largest companies in the US. Finding value may be more challenging for large companies but that’s not say it’s impossible for individual investors.

- A financial shock may be brewing – Buffet’s track record speaks for itself. He has tended to raise cash levels prior to financial shocks in the past, although he has generally been a few years early—like in 2003. There are always market risks to be cognisant of. At this juncture the list of risks is on the high side with inflation, war, and unsustainable US Government debt levels leading the way. Holding a higher cash balance in the face of these global market risks may well prove prudent in hindsight.

- Sitting on a large cash buffer is an empowered way to invest in general – Sitting on a lot of cash provides psychological advantages for investors that can’t be understated. For example, in the event of a market selloff, you are positioned to take advantage whilst others are fearful, and you’re able to focus on a long term investment horizon when others can’t. These mind-set advantages allow investors to remain calm and focused on achieving their long term investment goals. Of Buffet’s many lessons for investors over the decades, this has surely got to be one of the most useful.

An alternative interpretation

There’s also the possibility that there’s more going on with Berkshire Hathaway’s massive cash pile than normal investment considerations.

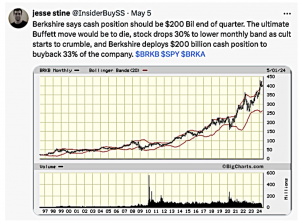

For example, with Buffet being 93 years old, the company’s investors are conscious of what’s coming next for Berkshire Hathaway after being led by a genius investor and manager for so many decades. With next steps in mind, some are wondering if the cash pile provides an opportunity to profit from any volatility as and when Buffet passes away:

Who knows whether there’s any truth in this perspective, but it’s easy to see Buffet’s positive influence continuing to generate value for investors from beyond the grave.

Learn from investment masters

Warren Buffet is arguably the most famous and quoted investor of all time, and he’s continuing to educate the masses as he builds upon his remarkable track record. Berkshire Hathaway’s $US189 billion cash pile could well be looked back upon as another act of genius. Whether the company is planning to take advantage of future market selloffs or buyback its own stock at a discount, its cash pile means it has got a number of compelling options available to it.

At the very least, Buffet is showing the market the value of holding a decent amount of cash in all portfolios.

Originally published on InvestmentMarkets