By Simon Turner, Head of Content, InvestmentMarkets

Thursday, 19 September

Remember how you felt about yield when interest rates were at historic lows? In those days when yield was scarce, investors placed a higher value on it, and it was of greater importance to investment valuations.

Then everything changed when the developed world’s central bankers raised rates at the fastest pace in history. Yield suddenly became more abundant, and the market took some time to adapt to this altered market environment. In short, it was bad news for yield-focused investors who had to watch their capital values fall as yields rose.

But with markets now expecting both the Fed and the RBA to start cutting rates in the short term, now may well be a good time for investors to refocus on yield.

Newsflash: rates are about to fall in the US

US rate cuts appear to be imminent. Markets are expecting a massive eight rate cuts by the Fed over the coming year—the most since the Global Financial Crisis in 2008.

That’s a serious shift from the one Fed rate cut markets expected back in April when the US economy had more momentum behind it. It’s also about as extreme as market expectations of a Fed rate cutting cycle get. Interestingly, every time markets have expected 200+ basis points of Fed rate cuts, a US recession has followed within a few months.

The market also expects rate cuts from the RBA, albeit not as many as in the US. The implied yield curve shows four rate cuts are expected by the end of 2025.

Whilst most economists don’t expect the Australian economy to fall into a recession in the short term, the RBA have arguably over-tightened rates versus the current strength of the Australian economy. Regardless of inflation running slightly above target, there’s surely a growing awareness amongst RBA board members of the lacklustre state of the economy.

In addition, if the Fed begins a rate cutting cycle, that will add to the list of reasons why the RBA shouldn’t be more hawkish than their main developed world counterpart.

So for Australia and the US (and developed markets in general), official interest rates appear likely to fall soon.

Mind the economic gap

It matters a great deal why the Fed and the RBA may be about to start cutting rates, rather than the rate cuts in isolation.

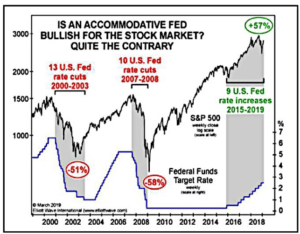

For example, if the Fed cuts rates because the US economy is decelerating, then there’s a clear risk that they are moving too late to avert a recession. There have been many precedents of this being the case in the past which explains why rate cuts have historically been negative for the S&P 500.

In fact, the last two Fed rate cutting cycles led to market declines of over 50%.

If history were to repeat if and when the Fed cuts rates, the knock-on effects are likely to be felt across global equity markets, including in Australia.

Yield matters

Yield is likely to matter a lot more to investors during a Fed (and RBA) rate cutting cycle. The reason is simple: when cash rates are falling, competition for higher yields rises which leads to outperformance by most higher yielding assets.

It’s not just the short term outlook that suggests yield is important. Over the long term, yield matters a lot to investors. As shown below (using US data), dividend growers and initiators and dividend payers have significantly outperformed the Equal-Weighted S&P 500 over the past four decades.

Source: Sure Dividend

There are a number of reasons why this is the case:

- Dividend paying companies generate free cash flow with which to pay dividends. That means these are generally proven business models with sustainable futures.

- The management teams of dividend paying companies tend to be shareholder friendly and focused on driving shareholder returns.

- Dividend paying companies have less cash available for acquisitions which means they have to be focused on organic growth opportunities and only the best acquisition opportunities.

So yield often reflects deeper drivers of investment success such as management mentality, a focus on organic growth, and business model stability. These attributes are likely to prove particularly attractive in the event of a weaker equity market at a time when cash rates are falling.

In that environment, investors are likely to be hungry for yielding stocks whose dividends are insulated from economic weakness.

There’s a but

No investment style is fool-proof and it’s the same with yield-focused investing.

All other things being equal, yielding investments are likely to trade on a lower yield once the Fed and the RBA’s rate cutting cycles begin in earnest. But if the Fed and the RBA cut rates in response to economic weakness, then a portion of dividend payers who are impacted by the economic weakness may be forced to cut or suspend their dividends.

So an essential part of being a successful yield-focused investor is the ability to effectively stress-test future dividends and distributions in a weaker economic scenario. Of course, this is easier said than done.

Tip: for a guide as to what may be coming, look backward at how companies have managed their dividend pay-outs during the Global Financial Crisis and the pandemic. It’s about as useful a guide as you’ll find.

Implications for investors

- Focus on investing with managers who are aiming to generate positive returns by investing in durable, defensive business models and assets with strong balance sheets with the goal of generating solid long-term returns with relatively low volatility.

- Invest prior to the expected Fed and RBA rate cutting cycles. Once the rate cutting begins in earnest, these yield-focused funds are well positioned to outperform.

Yield may be about to become more scarce

With the Fed and the RBA both probably approaching a rate cutting cycle, now appears to be an ideal time to focus on yield as an investor.

If the world’s central bankers do cut rates to the extent that the market currently expects, there’s likely to be pressure on yields across the board which means higher yielding stocks and assets are likely to outperform. Funds which combine a defensive strategy with a focus on yield are well positioned to benefit.

Originally published on InvestmentMarkets.